The 4 Best Project Management Software Tools for Accountants

- The Project Management Tool For Any Business: Flowlu

- The Project Management Tool for Heavy Collaboration: ClickUp

- The Project Management Tool With an Accounting Focus: SmartSuite

- The PM Tool Focused on Project Budgets: Scoro

- Choosing the Right Project Management Tool

- What you Need From Your Project Management Application

Choosing the right project management tool or service relies on your technology skills, the ability of the business to integrate and report accurately, with accountants often relied upon to ensure the numbers match the goals and deadlines. Check out 4 of the best project management tools appropriate for most businesses and project types.

Project management (PM) is an art form that many businesses lack the organization and resilience to handle properly. Spreadsheets have been used for decades, remaining the tool of choice for many. Still, project management software can better prepare tasks, processes, align teams and organization, and resources to ensure goals are met in an effective way.

That includes juggling the most time-consuming and complex tasks of any project; communication, timelines, budget, and project scope creep.

Accountants, as the natural monarchs of the spreadsheet, can often find themselves tracking aspects of a project beyond the budget. So, when a business looks for project management software (PMS) to improve control over the next grand plan, accountants must be ready to suggest or take control of one that best meets their needs.

If you want to see the arguments between spreadsheet users and PM tool aficionados, Reddit’s project management page is the rabbit hole to visit. It also provides plenty of insights into which roles get the best from a PM tool, and which services work better for particular types of project.

All that said and read, the PM tool (and remember they are just tools, not solutions, despite what the marketing says!) that your business chooses is the one that works with your projects, supports your existing and future data needs, and is accessible across the business, with these 4 among the most recommended in delivering business results and project success.

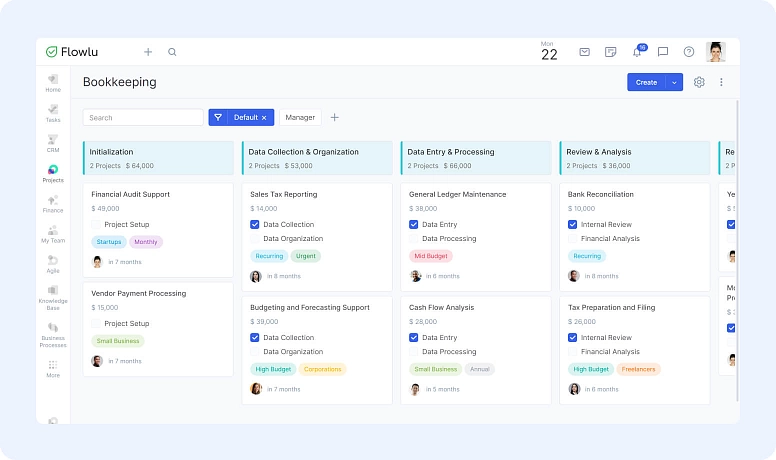

The Project Management Tool For Any Business: Flowlu

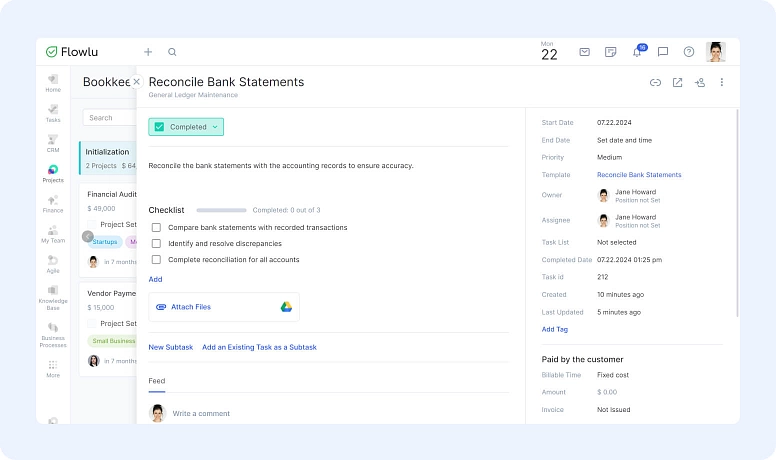

Flowlu is a project management tool that keeps everything organized while making financial tracking simple. Unlike some PM software that treats budgeting as an afterthought, Flowlu builds financial management right into the workflow. That makes it a great fit for accountants who need a clear view of project budgets, expenses, and profitability without switching between multiple tools.

Why Accountants Like Flowlu

- Task & Deadline Tracking: Set up tasks, assign them to team members, and track progress with clear timelines and reminders.

- Workflows & Automation: Streamline approvals, automate invoice reminders, and reduce manual data entry for smoother project operations.

- Collaboration & Communication: Keep discussions, project notes, and shared files in one place, so teams stay aligned without endless email chains.

- Document Management: Store financial records, contracts, and reports securely with easy access for team members and clients.

- Client & Vendor Management: Track interactions, contracts, and billing details for each client or vendor in a central system.

- Time Tracking & Billing: Log billable hours and link them directly to invoices for accurate client billing.

- Reporting & Analytics: Generate project reports, financial summaries, and team performance insights to stay informed.

Flowlu gives accountants a complete view of both financials and project progress, making it easier to manage budgets, deadlines, and team productivity—without jumping between multiple tools.

How Much Does It Cost?

Flowlu has a free plan for individuals and small teams. Paid plans start at $39 for a team of 8, which includes custom fields, time tracking, integrations, and automation. The Pro plan ($159 for a team of 25) adds advanced financial reporting and user role customization.

For accountants handling project budgets, Flowlu helps keep everything on track—without the headache of juggling multiple spreadsheets or chasing down numbers.

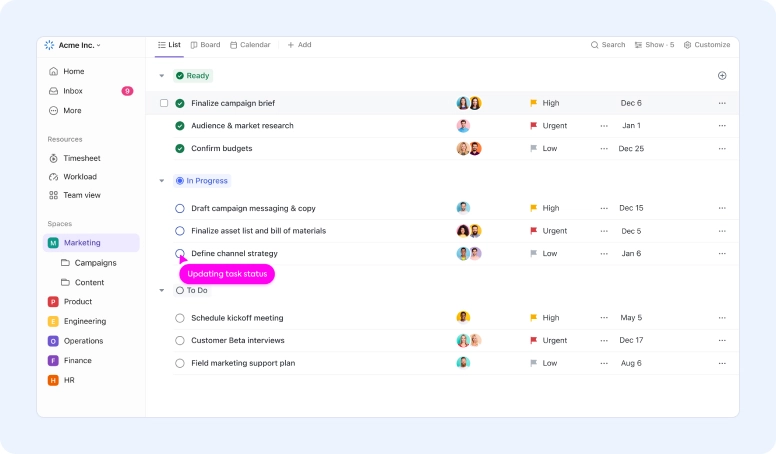

The Project Management Tool for Heavy Collaboration: ClickUp

ClickUp puts its chat and collaborative tools at the top of its feature list, highlighting its use in overcoming the collaboration hurdles of any project. With good workflows and timelines, it should be easy for any accountant to see where progress is being made (or not), and communicate with the members or partners responsible to get things done.

ClickUp starts off with the free limited model, and offers $7 or $12 per user to be a little more costly than Flowlu for small and mid-sized businesses ($8 x 8 users), with the usual POA enterprise model. But ClickUp’s AI, “Brain”, is available in the small business model, which might be an advantage for less technical businesses.

Brain makes it easy to connect apps, ask questions about how a project is working, build the tools that get the boring tasks completed quickly and accurately, and write reports or content faster than people can.

ClickUp University is a resource that helps new businesses or accountants and operators working on their first projects. It provides individuals or teams with advice and insights on how to build a better project, and use ClickUp as part of that process.

All of this makes ClickUp a promising product for accountants growing into the project management space or working with less experienced teams or clients on their projects.

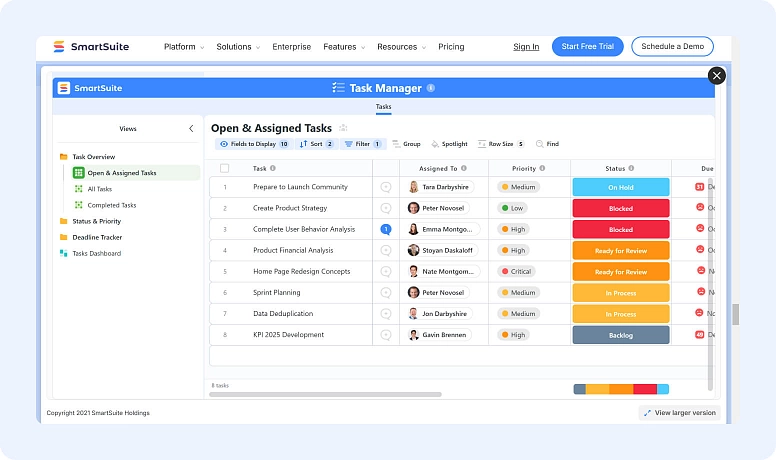

The Project Management Tool With an Accounting Focus: SmartSuite

For accountants focused on the business-end of any project management, SmartSuite is often badged as one of the best tools for that specific role. Cascading the data, information and workflows into your core financial processes is how accountants need to operate and identify success or issues.,

SmartSuite offers budget requests and tracking, purchasing, monitoring the financial performance of a project, capital investments, taxation management, and other aspects of a growing project. That combination within a single system makes SmartSuite a powerful tool for accountants, while packing the usual features such as workflows, dashboards and charting, calendars, collaboration, and powerful reporting.

With real-time notifications, accountants can get alerts the moment a deadline is reached or something operational or financial strays out of normal bounds.

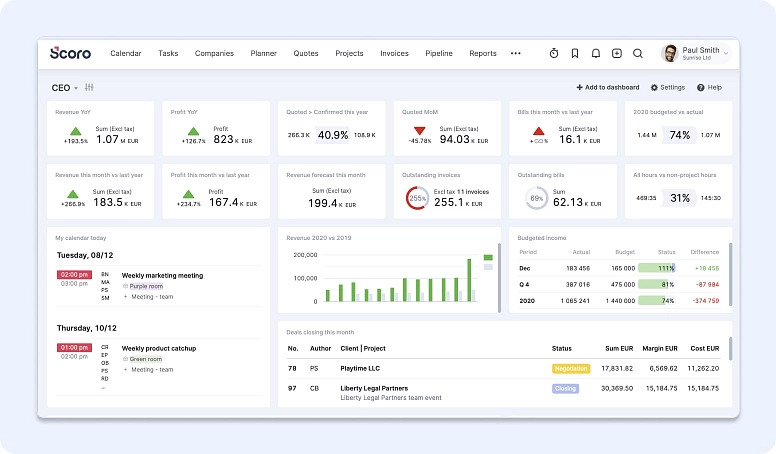

The PM Tool Focused on Project Budgets: Scoro

If the majority of a project is focused on cost control, large numbers of customers and strong repeatable business, then Scoro offers budget planning, cost management and analysis. Enabling accountants to run the show with clear visibility on live projects.

Focused on consultancy and agency work, engineering projects, and software development projects, it is ideal for those moving into digital business that demands fast and accurate tracking of complex projects. Financial managers and accountants can take charge of the project with automated invoicing and financial reporting, and Scoro links with most financial tools for a full audit and compliance service.

Agencies, typically Design and PR or marketing firms, often lack the accounting experience on their team for projects. The likes of Scoro are ideal in providing the security of a class SaaS product, while accounting partners can use it in the knowledge that non-technical or financial workers can fill in the data to keep projects on the rails, with high levels of security to protect financial data.

Choosing the Right Project Management Tool

If you work in a specific vertical, such as construction or healthcare, there are plenty of specific project management tools with features for those markets. For general use, realistically, if you have the time, accountants should investigate the free trial versions for suitable products. Otherwise, write down a list of your criteria, and prioritize them. Then choose the product that best aligns with your requirements, working through the feature lists to find the best one that meets your needs.

Alternative sources of information include accounting forums that recount many tales of practical experience with various PM products. They can help identify operational strengths and weaknesses that might not be obvious in the marketing and company website.

For larger organizations, run the software through a pilot or test to see if it meets your needs, if people like using it, and if there are gaping omissions in the feature or integration set. You can also use data from a previous project to see how it works in a near-live situation.

What you Need From Your Project Management Application

Success can be measured in various ways, from reducing meetings, improving ROI or saving time, but the ultimate aim of complete project success is what most businesses look for, and the right tool can deliver for your teams. For accountants, that can involve supporting your budgeting and risk management, improving your own project management skills, and setting the right milestones or controls.

This requires a clear and understandable user interface, accessibility across mobile apps, and a clear reporting system. And for larger projects that cross borders and boundaries, understanding the bookkeeping needs of a business, say when working between the U.S. and U.K, you may need independent accounting advice alongside PSM applications that are flexible enough to handle multiple currencies and taxation regimes.

Success can be measured in various ways, from reducing meetings, improving ROI or saving time, but the ultimate aim of complete project success is what most businesses look for, and the right tool can deliver that for your teams. For accountants, that can involve supporting your budgeting and risk management, improving your own project management skills, and setting the right milestones or controls.

With its built-in financial tracking, budgeting tools, and automation features, Flowlu is one option that checks all these boxes while keeping everything in one place.

Accountants do more than just crunch numbers—they also keep projects financially on track. A good project management tool helps them stay on top of budgets, track expenses, and make sure everything adds up without switching between multiple systems.

The most useful features include budget tracking, expense management, invoicing, financial reports, and accounting software integrations. Time tracking, cost estimates, and automation for things like invoice approvals and tax calculations can also save a lot of time.

Flowlu keeps everything in one place, so accountants don’t have to juggle spreadsheets and separate tools. It tracks budgets, expenses, invoices, and project profitability, plus it automates billing and financial reports—making it easier to keep projects on track without extra hassle.