A Comprehensive Guide to 3-Way Matching

- What is 3-Way Matching in Accounts Payable?

- Why Do Different Persons Need to Prepare Each Type of Document?

- How Does a 3-Way Matching Work?

- Practical Examples of the 3-Way Matching Process

- What is a 2-Way and 4-Way Matching?

- Pros and Cons of 3-Way Matching for Bbusinesses

- The Risks of Manual Matching vs. Automated Matching

- Benefits of Automating 3-Way Matching

- Wrapping Up

AP or Accounts Payable professionals play a crucial role in businesses avoiding this by carefully monitoring and validating whether a particular invoice due for payment exists in the company’s books and whether documents exist to support the payment.

Hear this: a report from the 2024 AFP Payments Fraud and Control Survey Report indicates that 80 percent of organizations became victims of payment fraud attacks or attempts in 2023. With this massive turnout, it’s no surprise that cybercriminals and fraudsters continuously target companies with weak AP processes. This is why it’s detrimental for companies to examine the legitimacy of accounts payable and invoices through a technique called 3-way matching.

Now sit back, take notes, and let’s talk about everything you need to know about 3-way matching, how it helps your business, its automation, and examples of its practical applications in a real business setting.

What is 3-Way Matching in Accounts Payable?

As an AP invoice matching process, the 3-way matching matches an invoice to its purchase order (PO) and goods receipt. It helps determine whether an invoice is a legitimate business transaction and should be processed for payment by the AP in charge.

This cross-referencing process verifies the transaction's legitimacy regarding the product, quantity ordered, quantity price, payment terms, delivery fees, and banking details. For many businesses, banking details are included in the invoice and the purchase order to verify that payment details are correct and payment is made to the proper vendor or supplier.

The 3-way matching helps ensure that all three documents reflect the same information, making them ready for the AP in charge to pay in whole or in part.

You need all three documents—invoice, purchase order, and delivery receipt—to be prepared by different and independent persons for this process to be effective.

Why Do Different Persons Need to Prepare Each Type of Document?

In a corporate setting, these three documents are typically prepared by different departments and individuals; however, this may not always be true for small to medium-sized entities, which can be a critical financial mistake.

The importance of delegating the creation of purchase orders and delivery receipts, performing the 3-way matching, and processing payments rests on a straightforward concept: conflict of interest.

When a single employee is responsible for procuring orders, processing payments, and receiving them, personal interests cloud the employee’s judgment and actions. This increases the risk of fraud and theft, particularly kickback schemes, billing frauds, overbilling, or payment tampering.

How Does a 3-Way Matching Work?

As a payment verification process, the three-way matching involves several documents and stakeholders to ensure independence. When one of these documents doesn’t match, or when one person prepares two or more documents, management must take swift action to rule out potential fraud.

3-way matching documents

- Invoice: A document that triggers the 3-way matching process. Initiates the payment request from the vendor or supplier for the goods or services purchased, either in whole or in part.

- Purchase order: A document that contains the final details of a buyer’s order from the vendor. It includes the complete description and specifications, the amount, the number of items, delivery fees, and the vendor's banking details. It may also include any penalty clause that the buyer may require for any late delivery or incorrect delivery of goods by the vendor.

- Delivery, goods receipt, or waybill: Depending on the purchase terms, this document confirms that the buyer has received or acknowledged the shipment of the goods.

For a PO with terms of payment upon delivery, a 3-way matching must be used to examine the delivery receipt with the PO and the invoice.

For a PO with terms of payment upon shipment, a 3-way matching must be done to examine the shipping waybill with the PO and the invoice. This typically happens for orders made internationally and requires shipment of goods by air (air waybill) or cargo (shipping waybill).

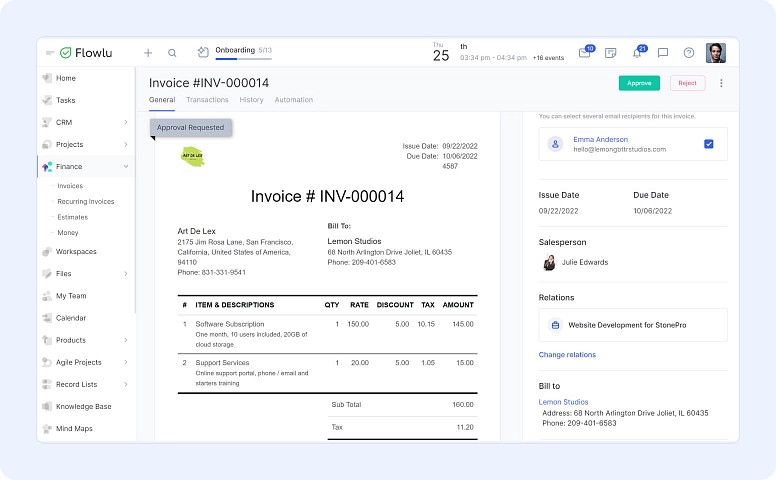

Tools like Flowlu simplify document management through their document builder, allowing businesses to easily create and customize invoices, purchase orders, delivery receipts, or any other type of document required for processes like 3-way matching. This ensures consistency, accuracy, and professional formatting across all financial and operational paperwork.

3-way matching stakeholders

| STAKEHOLDER | DEPARTMENT/AFFILIATION | FUNCTION IN THE THREE-WAY MATCHING PROCESS |

| Supplier or Vendor |

External Stakeholder |

It triggers the 3-way matching process by issuing an invoice to request payment for goods delivered or services rendered. |

|

Accounting AP in-charge |

Accounting Department |

Performs the 3-way matching by examining relevant documents to verify the validity and correctness of the invoice, and the subsequent payment request is processed. |

|

Procurement or purchasing in-charge |

Purchasing Department |

In charge of sourcing for suppliers and vendors and making purchase orders. |

|

Materials management in-charge |

Materials Management Department |

In-charge of receiving the items ordered while cross-checking them with the PO upon receipt. |

|

Finance or payment in charge |

Finance Department |

Processes the payment to the vendor either through telegraphic transfer, check, or cash. |

Practical Examples of the 3-Way Matching Process

Consider the following situation that illustrates the 3-way matching process:

Company ABC is in the sugar manufacturing business and is looking for an international supplier of mill-bearing parts for their off-milling repair season. The purchase order term is set at payment upon delivery.

- Step 1: The relevant department of Company ABC in need of the mill-bearing parts would need to request to purchase the items with the procurement or purchasing department through a material requisition form.

- Step 2: The purchasing department receives the material requisition form, sources for international suppliers that could supply the correct bearing specifications, and makes a purchase order (PO) to confirm the order. The purchasing department furnishes the supplier with a copy of the PO, with copies also sent to the Accounting Department.

- Step 3: The vendor ships the goods.

- Step 4: The materials department receives the goods, cross-checks the specifications with the PO, accepts the delivery, and issues a delivery receipt.

- Step 5: The vendor or supplier issues an invoice to request the payment of the mill-bearing parts.

- Step 6: The AP in charge or Company ABC cross-checks all relevant documents using 3-way matching (invoice, PO, and delivery receipt) to confirm whether all information matches.

- Step 7: Once the AP in charge finds no issues with the documents, they request payment for the invoice, attaching all relevant documents.

- Step 8: The Finance Department processes payment for the vendor or supplier. The transaction is completed.

What is a 2-Way and 4-Way Matching?

The 2-way matching

A 2-way matching process involves only the invoice and purchase order. It usually takes less time than other matching types and is typically used for regular and recurring purchases. It also usually requires less time, effort, and resources than 3-way and 4-way matching.

The 4-way matching

The 4-way matching process provides another layer of protection against fraud and wasted resources regarding internal control and transaction validation. In addition to the invoice, purchase order, and delivery receipt, the four-way matching process considers the quality inspection report of the items or goods received by the materials in charge.

While this is unnecessary for all businesses and transactions, business owners can choose to employ the 4-way matching for materials or goods that should always be in good condition. For example, Company ABC (as stated in the previous example) can conduct a quality control inspection of the mill bearing received before the payment to ensure it is in good condition, as defective mill-bearing parts can cause the entire sugar milling process to malfunction.

It is well within your right as a consumer to refuse an item or product of a subpar quality or one that doesn’t meet the specifications required in your order. This is why businesses must read the terms and conditions of their purchase and inspect goods as they arrive, as most return and refund policies have time limitations.

When do you use 3-way matching?

While 2-way matching lacks internal control, and 4-way matching is too labor-intensive and resource-intensive for most businesses, 3-way matching uses just enough resources with enough internal controls to protect the company from fraud and cybercriminals who try to take advantage of weak documentation and internal processes to steal money.

When resources and documentation are available, using the 3-way matching is the most resource-friendly and effective way to validate the legitimacy of business transactions with external suppliers.

Pros and Cons of 3-Way Matching for Bbusinesses

Pros

- Saves money: Effective 3-way matching helps ensure the accuracy of the amount and quantity paid to a vendor, preventing misrepresentations of incorrect amounts paid due to a lack of cross-referencing with purchase documents.

- Improve supplier-business relationship: The key to good business relationships is when both buyer and vendor make a significant effort to ensure that resources are correct, paid, and given on time. A 3-way matching helps ensure suppliers that internal controls are in place with the business and that decisive actions are taken against potential fraudulent activities, increasing trust and business relationship between both parties.

- Strengthen internal protocols against fraud: AP fraud is prevalent in businesses with weak documentation and internal processes. The 3-way matching helps reduce this risk, avoiding the waste of money, time, and resources.

- Helps businesses prepare for audit: Whether external or internal audits, employing the 3-way matching allows companies to be confident in their internal processes. It ensures that internal and external auditors have enough financial documentation to ensure that the company operates correctly and uses resources effectively.

Cons

- Complex and labor-intensive: Compared to 2-way matching, 3-way matching requires more documentation and inspection of another set of documents, increasing the time the AP in charge spends on each transaction.

- Inability to check the quality of goods received: The 3-way matching disregards the quality of goods received before payment, so any item can be received and paid for despite being subpar.

- Prone to human error: As the 3-way matching process can be complex, the chances of misplacing documents, misreading amounts and quantity, and misinterpreting terms are likely, especially when matching is done manually.

According to Jonathan Feniak, General Counsel at LLC Attorney, “Internal and external audits both have the same goal: to ensure that the business is operating efficiently, properly, and in compliance with relevant laws and regulations.” He adds, “A business fully compliant with the law can still be a target for fraudulent schemes, and the lack of internal controls, like invoice matching processes, can result in negative audit outcomes that can trigger fraud investigations.”

The Risks of Manual Matching vs. Automated Matching

Not all businesses have enough resources to employ advanced technology and avoid manual matching processes. These processes put accounting and finance departments at risk of human errors, from misplacing manual documents to reading amounts incorrectly, which can lead to overpayments or risk business relationships.

Here are other drawbacks of sticking to manual matching processes:

- Financial losses can stem from overpayment of invoices.

- Loss of trust with supplier and vendor partners due to frequent underpayment and clerical errors.

- Processing 3-way matching manually can be time-consuming and result in late supplier payments due to the volume of paperwork that the company could have otherwise automated.

- Increased frequency of loss or misplacing of physical documents.

- The AP in charge is under increased pressure to manage high volumes of physical data, make payments on time, and verify the accuracy of all documents per transaction, which can lead to more frequent employee turnover.

While a buyer can address overpayment issues by creating a credit memo or requesting a refund from the vendor, there are instances where vendors tend to ignore clients who have mistakenly overpaid their accounts. You can file a legal complaint when this happens, but recovery may take long, depending on the gravity of the situation.

Benefits of Automating 3-Way Matching

Modern businesses need to adapt to modern times. One way to do this is to leverage technology to reallocate labor resources to more value-adding tasks rather than manually performing repetitive tasks like 3-way matching, which multiple accounting automation programs can easily do.

When a company chooses to automate its business processes, like its AP system, it will automatically compare invoices, purchase orders, and delivery receipts, ensure that all details match, quickly identify an invoice as valid for payment, and process payment to the vendor or supplier. This reduces the chances of human error and speeds up vendor payment.

Here are more notable benefits from automating the AP system and the 3-way matching process:

- It helps reduce backlogs, avoid delayed payments, and save interest and charges on defaulted accounts.

- Take advantage of early payment discounts.

- Early and timely payments can D and lead to better negotiating terms with vendors.

Automation doesn’t automatically translate to employees losing their jobs. Training AP professionals with automated business processes can help eliminate repetitive and time-consuming tasks and focus on more vital AP duties, such as managing AP aging reports, nurturing vendor relationships, negotiating terms, analyzing discrepancies, and analyzing vendor contracts.

Wrapping Up

There is no right or wrong answer regarding which AP invoice matching process is right for a business. Depending on the scale of your business, available resources, risk appetite, and motivation to improve and maintain sound internal controls, using AP invoice matching, like the 3-way matching, can help reduce the risk of fraud and waste resources that fraudsters would otherwise target on companies with weak internal controls.

Employing the 3-way matching process, particularly automating it, helps advance your business. It allows you to use your money, time, or human resources in more value-adding tasks that can improve business operations and overall performance.

Flowlu helps make your AP processes easier by giving you tools to automate tasks, create documents, and handle financial management. With Flowlu, you can simplify 3-way matching, keep your paperwork accurate, and free up time and energy for more important things. It’s a practical way to stay organized and keep your business running smoothly.

3-way matching makes sure invoices, purchase orders, and delivery receipts all match up. It’s a way to catch errors and spot anything suspicious before payments are made. This process helps protect your business from mistakes and dishonest activity.

Small businesses can benefit a lot from 3-way matching. It keeps things organized and helps avoid costly errors. Even if you don’t have a big team, using tools that simplify the process—like creating documents automatically—can make it manageable without a ton of extra effort.

Automating 3-way matching takes a lot of the manual work off your plate. Instead of cross-checking everything by hand, software can compare documents for you and flag anything that doesn’t match. It saves time, reduces mistakes, and makes the whole process less stressful.