Keeping Track of Business Expenses: Your Ultimate Guide

- What Are Business Expenses?

- What to Keep Track of for Small Business?

- 9 Benefits of Tracking Business Expenses

- How to Track Expenses for Small Business – 6 Steps

- How to Choose the Best Business Expense Tracking App

- 5 Best Tools for Keeping Track of Business Expenses

- 3 Tips for Tracking Business Expenses

- Bottom Line

As a business owner, you’re always dealing with a lot of things and tasks at hand. And you know that some are more important than others. When it comes to keeping track of your hard-earned money, you want to make sure you make it a priority.

One of these tasks is keeping up with business expenses. By doing this, you’re making sure that you’ll be ready for tax season—not to mention that you’ll be on top of your cash flow.

Now, you don’t need to be nervous in any way. You don’t need an accounting degree. If you’re looking to know more about how to organize expenses for a small business and how to manage expenses for a small business, you’re in the right place. All you need to do is keep reading.

What Are Business Expenses?

Before we can start explaining how to track your small business expenses, it’s important that you understand what business expenses are in the first place.

The truth is that business expenses are very broad and cover too many things. Some business expense examples include:

- Office supplies such as computers, paper, pens, and similar items

- Software costs, including annual or monthly fees for the SaaS tools you use in your small business

- Marketing expenses such as promotions, brand-building, and ads

- Rent

- Utilities: water, electricity, and internet

- Personnel costs like wages, salaries, and benefits for your employees

- Travel expenses that include the costs of business trips (flights, hotels, and rental cars)

What to Keep Track of for Small Business?

Now that you already know what business expenses are, it’s time to start keeping track of expenses for small businesses.

The first step is to always identify them to ensure that you have good insight into the financial health of your business or company. Besides, it also helps you comply with tax laws and policies and with effective budgeting.

One of the things that is really important to do when you are keeping track of business income and expenses is to identify the expenses that are tax-deductible. In case you don’t know, these are the expenses that you can subtract from your total income, according to the tax authorities. This will usually help you lower the tax amount you owe and stay in compliance.

9 Benefits of Tracking Business Expenses

While we understand that you might already be aware of some of the benefits of keeping track of your business expenses, we want to ensure that you get a good insight into the most important advantages of doing so.

#1: Improved Accuracy

When you have a complete record of your expenses, you’re not only improving accuracy—you’re also preventing discrepancies.

#2: Increased Profitability

If you minimize your expenses and optimize your budget, you’re immediately increasing the profitability of your business.

#3: Easier Resource Allocation

When you’re on top of your expenses, it becomes much easier to allocate resources where they’re needed most. That could be employee bonuses, office supplies, or even travel.

#4: Maximize Tax Deductions

As a business owner, you know that tax-related tasks shouldn’t be left until the last minute. Keeping track of your expenses can help a lot. You can immediately categorize deductible ones, which will allow you to save money—year after year.

#5: Track Cash Flow

When you track expenses, you know exactly where every cent goes. You won’t be expecting to have money in an account only to find it’s already gone.

#6: Make Better Financial Decisions & Plan Accordingly

If you keep track of your business expenses, it’s easy to identify patterns that help you make smarter decisions. In the long run, it makes planning more effective too.

#7: Discover Cost-Saving Opportunities

As a business owner, you’re always looking for opportunities to cut costs. If you can spend less on the same items—or spend the same on better ones—it’s a win.

#8: Up-to-Date Financial Records

The truth is, you never know when auditors might ask to see your books. So, it’s smart to stay ready.

#9: Use It to Forecast Expenses

There’s nothing like past data to help you predict future spending. And you can do that just by consistently tracking your expenses.

How to Track Expenses for Small Business – 6 Steps

It’s normal that, at this moment, you’re thinking about how to keep track of expenses and profit. After all, that’s the most logical step.

Generally speaking, the best way to keep track of business expenses involves services and software, recordkeeping, and reporting—all working together. As you can easily understand, the use of technology is a must and a tremendous help.

Step #1: Open a Business Bank Account:

The first thing you need to do to start tracking your expenses is to separate your finances and funds between personal and business. Opening a business bank account is the natural step to do this. After all, when you have your business finances separated from your personal finances, you not only gain more credibility—it also becomes easier for tax reporting, keeping clean financial records, and tracking cash flow. You may also want a credit card associated with this new account. It should be easy to get approved.

When you’re opening a business account, make sure that you get treasury for yield, checking, and a vault to protect non-cash items.

If you’re ready to open your new account, make sure you have proof of business ownership, your tax identification number, and your business license with you.

Step #2: Choose an Accounting System:

The best way to keep up with business expenses is to choose the best accounting system for your company. As soon as you have your new business bank account created, it’s time to make this decision.

Generally speaking, you have two options: accrual and cash. While an accrual accounting system records both revenues and expenses exactly when they occur, a cash accounting system only acknowledges revenues or expenses when there is cash involved.

Step #3: Decide the Categories:

As we already mentioned above, you’ll need to set categories for your expenses to ensure that your financial records stay well organized. Depending on your business, you may need more or fewer categories, but here are some that are commonly used:

- Rent

- Utilities

- Travel

- Office supplies

- Tech subscriptions

- Marketing

Step #4: Link Your Bank Account to Your Accounting Software:

The best way to track business expenses for taxes is to connect your new bank account with the accounting software you use. After all, this will simplify your life a lot, since you can easily download all business transactions directly into your software. With this, you’re not only protecting your financial data—you’re also getting better insights at the same time.

If you’re looking for an all-in-one solution that handles expenses, invoicing, and project management in one place, Flowlu is worth checking out. It lets you link your accounts, categorize expenses, and keep everything organized in real time—no spreadsheets required.

Step #5: Manage Your Receipts:

While you may like to keep all your receipts on paper, it’s wise to make copies to ensure you don’t lose track of anything. Plus, it’ll be much easier to access them later if you need to provide proof for write-offs or tax deductions.

Step #6: Record & Review Your Expenses:

You should always make sure to accurately record all your business expenses—and review them one by one before audit season hits.

One thing you might consider is using an automated process. But if you prefer to do it manually, it’s best to use an app or software that allows you to log expenses at regular intervals—like at the end of each month. Following a schedule makes it easier to stay consistent and avoid forgetting important entries.

How to Choose the Best Business Expense Tracking App

No matter if you’re looking for how to keep track of expenses for an LLC or how to track finances for a small business, you want to make sure you find the best app to keep track of business expenses.

The reality is that, even though you might be considering tracking your expenses manually, we have to tell you—it’s a daunting task. It’s not only time-consuming but also prone to errors and can get frustrating quickly.

If you’ve never used a business profit tracker before, there’s nothing to be afraid of. However, it’s important to choose the right one for your company. So, here are some features the best app to track small business expenses should include:

#1: Multiple Currencies:

If your business operates in other countries, it’s important that the app supports multiple currencies. This simplifies your life—you won’t have to deal with manual conversions all the time.

#2: Fast Reimbursement:

Employee reimbursements need to be handled quickly to avoid delays and keep your team happy. With the right expense tracking app, reimbursements can be automated, ensuring employees are paid back promptly for out-of-pocket business expenses.

#3: Customizable:

When you’re looking for the best app to track business expenses, make sure it’s customizable. You should be able to create workflows that match the way your business operates. Also, pick a tool that can scale with your business and adapt to any changes you make in the future.

#4: Integrations:

There’s no question that the best business expense tracker should allow for integrations. This gives you better visibility into your financial data. The best apps may also offer transaction statements, reports, and other digital insights you’ll want to access.

#5: Security:

Keeping your data secure is crucial. That’s why you need to be extra careful when choosing the best business expense tracking software. The tool you select should automatically store receipts, use multi-factor authentication, and regularly back up your data.

#6: Price:

Price is always an important factor—especially for small businesses. But it pays to be careful. While there are free tools available to track expenses, they’re often limited in features. On the other hand, the most expensive option might include tools you don’t even need. Simply put, choose a solution that fits your needs and your budget.

5 Best Tools for Keeping Track of Business Expenses

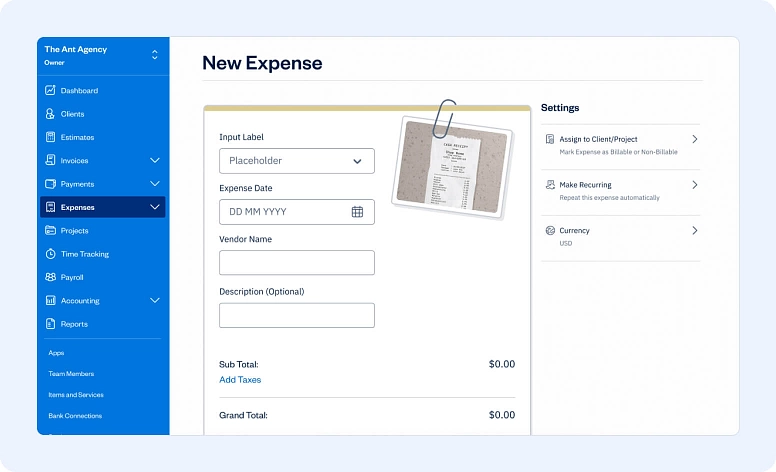

#1: Freshbooks:

FreshBooks is one of the best expense tracking software options for small businesses. It’s often considered the top expense tracking app for sole proprietors, as it was specifically designed for freelancers and independent business owners.

One of the best things about FreshBooks is that it’s extremely easy to set up and start using—even if you don’t have any prior experience with this kind of tool.

Cloud-based and user-friendly, this app not only helps you track your expenses, but also includes other useful features like comprehensive analytics and reporting, time tracking, invoicing, and payment processing. You can also integrate it with e-commerce platforms, project management tools, payroll services, and payment processors.

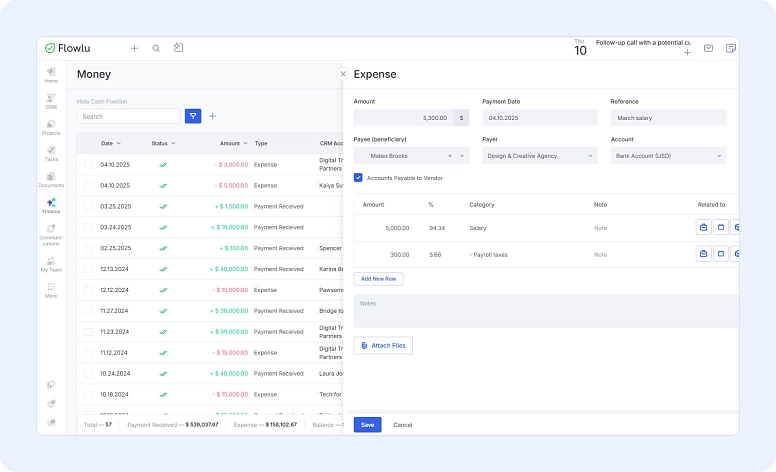

#2: Flowlu:

When you are looking for an easy way to keep track of business expenses, you should take a look at Flowlu.

Flowlu is a very complete platform that allows independent businesses to manage their business. From maintaining client relationships to capturing new business, online payments, and invoicing, it’s easy to use this software.

One of the things we like about Flowlu is that you can immediately categorize your expenses as you add them. And if you’ve never made this separation before, Flowlu already comes with dozens of categories to help you get started.

You can also record estimated expenses by project and later compare them to actual costs, giving you a clear view of budget accuracy and helping you adjust future plans accordingly. This makes Flowlu especially helpful for project-based businesses that need tighter cost control.

Flowlu is also a great solution in terms of integrations. It connects with many apps, including QuickBooks (via third-party tools like Make or Pabbly), which cuts down the time it takes to manage and sync data. This ensures that you can keep track of both your expenses and revenues from just one place.

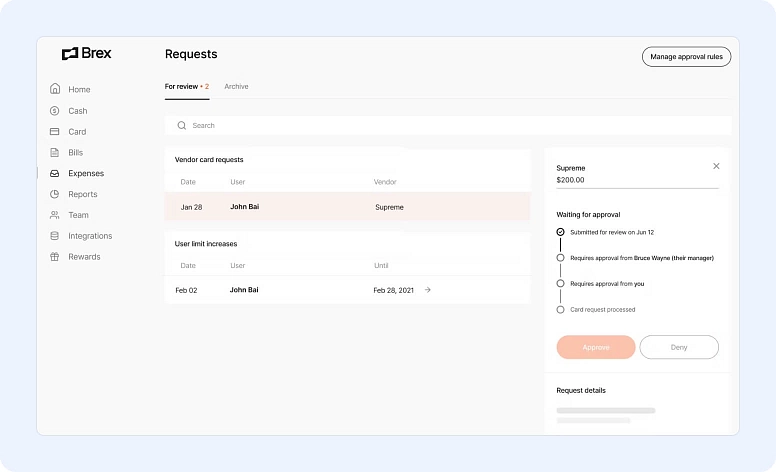

#3: Brex:

If you’re looking for the best way to track business expenses, you should take a closer look at Brex.

Simply put, Brex is a complete expense management platform designed especially for corporate businesses. So, you can expect features such as travel management, global expenses, bill pay, business credit cards, and reimbursements. If you run a larger company, you may also benefit from built-in AI and automation.

While Brex offers a wide range of features and might seem complex, it’s actually user-friendly—and many business owners consider it one of the best software tools for tracking business expenses. With accounting software integrations, automatic receipt scanning, customizable expense policies, multiple currency support, and more, Brex is certainly an app to consider.

#4: MileIQ:

Designed specifically for small businesses, MileIQ is one of the best tools to track small business expenses in 2025.

No matter if you’re a real estate agent, a wedding planner, or a photographer, you’ll enjoy the simplicity of MileIQ. While it doesn’t offer as many features as Brex, it’s still a solid option. If you’re looking for a simple yet effective tool to track your expenses only, MileIQ is the way to go.

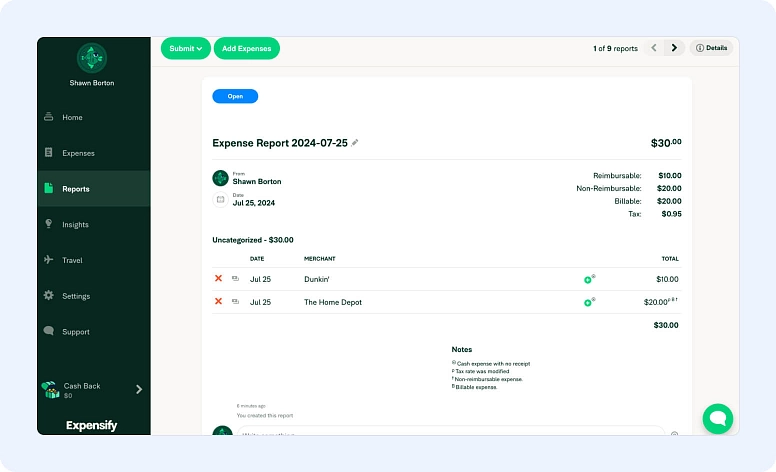

#5: Expensify:

When you’re looking for the best way to track income for a small business—and the best way to record business expenses at the same time—Expensify is worth a closer look.

Expensify is a simple yet powerful platform that helps you accurately track your business expenses and handle reimbursements.

One of the things we like about Expensify is how easy it is to use SmartScan: just click, and it captures all the details from your receipt. Beyond that, you can customize workflows, reconcile credit cards, and make payments to over 190 countries. Plus, the platform integrates with travel apps, HR platforms, and accounting software.

3 Tips for Tracking Business Expenses

When you’re looking for the easiest way to keep track of business expenses, make sure to take a look at the following tips:

#1: Your Financial Knowledge:

Choosing the best expense tracking tool for your small business depends not only on the features the software includes but also on your level of financial knowledge. For example, if you have only a few expenses, you may be fine with a simpler solution. On the other hand, if you manage many expenses and multiple business accounts, you may want software that includes more robust categorization tools.

#2: Hire a Bookkeeper:

While you may be searching for the best program to track business expenses, that doesn’t mean you should rule out hiring a bookkeeper. A professional can help you understand your finances better—and make sure nothing important slips through the cracks.

#3: Identify Tax-Deductible Expenses:

As mentioned earlier, identifying tax-deductible expenses can help you save money and improve your bottom line. Some common tax-deductible expenses include rent, advertising, vehicles, housing, banking fees, travel, repairs, food, and employee-related costs.

Bottom Line

Keeping track of your expenses is a regular task that needs to be done. So, the best way to approach it is to find good software or an app to help you out.

Depending on your business activity, you may need a more complex or a simpler tool. If you're looking for an all-in-one solution that covers everything from expense tracking to project budgeting, Flowlu is a great place to start.

There’s no question that the best way to track expenses for taxes is by using a reliable expense tracker for small businesses. The best ones let you automate the tracking process, streamlining expense submissions, approvals, and reimbursements.

The best expense tracking software for small businesses is the one that fits your needs. Check the features each tool offers and determine if it suits your business operations. It’s not about the most popular app—it’s about what works best for your workflow.

Yes, Flowlu is a nice choice for tracking business expenses—especially if you want everything in one place. It lets you categorize costs, link your bank accounts, and even compare estimated vs. actual expenses for each project. It’s a good option for small businesses that need more than just a spreadsheet.