Cash Flow Calculator: Explore Types of Cash Flow Formulas

The reason is crystal clear. Without proper understanding and guidance regarding calculating cash flow, it's not possible to manage it. Here, you would need a cash flow calculator and proper knowledge of the formulas.

Here, we will define the top cash flow formulas you can use when it comes to finding cash flow. No matter what kind of business you handle, of any size or scale.

Cash Flow Formulas You Must Know

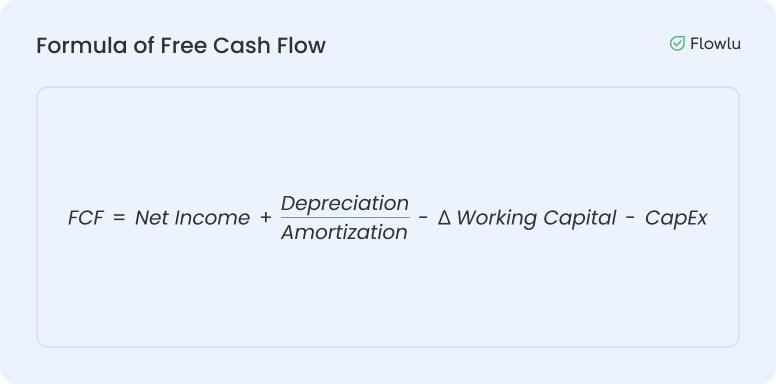

1. Free Cash Flow Formula

One of the most commonly used cash flow formulas is Free Cash Flow (FCF). It is especially useful for providing more accurate financial metrics for a business. The formula is as follows:

Here,

-

Net Income: The profit calculated by subtracting total business expenditures from total sales or revenue.

-

Depreciation/Amortization:

-

Depreciation: The reduction in the value of equipment or assets over time due to usage or wear and tear.

-

Amortization: The process of spreading the initial cost of an intangible asset over its useful life.

-

Working Capital: The difference between a company’s current assets (like cash, inventory, and receivables) and its current liabilities (like payables and short-term debt).

-

Capital Expenditures (CapEx): Funds spent on the business, including costs for rent, land, equipment, and other significant purchases.

Which Businesses Can Use NCF?

-

Media & Entertainment

-

Construction

-

Hospitality

-

Automobile services

Example of Free Cash Flow Formula

Suppose a startup company named Orange Technolabs Private Limited wants to check its FCF. It has the following details as below:

-

Net income = $100,000

-

Depreciation/Amortization = $100

-

Change in working capital = $20,000

-

Capital expenditure = $3,500

Now, to calculate free cash flow, we use the above formula and compute the result as follows:

FCF = $100,000 + $100 - $20,000 - $3,500 = $76,600

This is the total amount available for the company to invest.

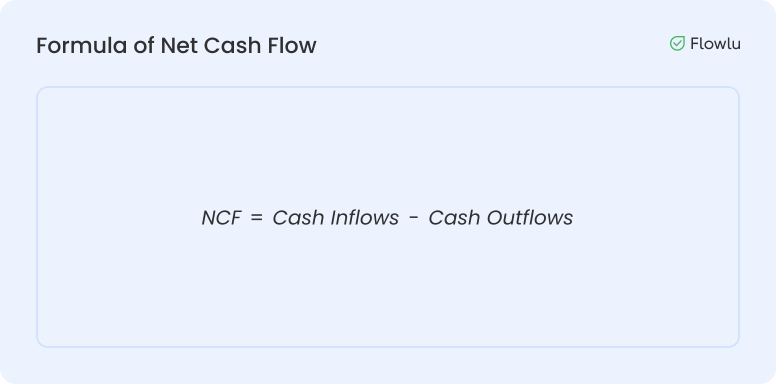

2. Net Cash Flow Formula

Business owners use a net cash flow formula on a regular basis. It represents the difference between the incoming money and the outgoing money of a business over a specific period. Here is the formula to use when it comes to calculating net cash flow.

The net cash flow of any business can be obtained from its financing, investment, and operating activities. Let's understand each of them here:

-

Financing: Company shares, dividend payments, and small business loans.

-

Investment: The earning or payment of interest on investments.

-

Operating: It covers the cost of goods sold and payments made by the customer.

Which Businesses Can Use Net Cash Flow?

-

Startup businesses

-

Healthcare

-

Retail and food services

-

Media industries

Example of Net Cash Flow Formula

Let's understand the net cash flow while considering the above example. Suppose the same company, named Orange Technolabs, has the following cash flow from different activities. When it is about checking the net cash flow, we can calculate it as follows:

Cash flow from financial activities

-

Cash in: $5,000

-

Cash out: $4,000

$5,000−$4,000=$1,000

Cash flow from investment activities

-

Cash in: $6,000

-

Cash out: $1,000

$6,000−$1,000=$5,000

Cash flow from operating activities

-

Cash in: $15,000

-

Cash out: $10,000

$15,000−$10,000=$5,000

Net Cash Flow = Total cash flows of all activities

$1,000+$5,000+$5,000=$11,00

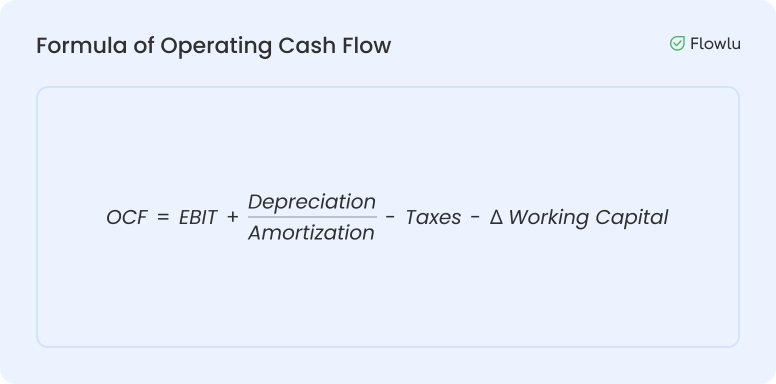

3. Operating Cash Flow Formula

When the business sells out large assets, FCF is not a suitable option to have a clear picture of your finances. In this condition, operating cash flow is the best formula for cash flow to choose for better insight into your finances.

- Operating Income (EBIT): Also known as Earnings Before Interest and Taxes, this represents the business's profit generated from core operations, calculated by deducting operating expenses (excluding interest and taxes) from gross income.

- Depreciation/Amortization: Non-cash expenses that reflect the gradual reduction in the value of tangible and intangible assets over time due to wear, tear, or obsolescence.

- Taxes: The total applicable taxes based on the business's income.

- Change in Working Capital (ΔWorking CapitalΔWorking Capital): Variation in accounts payable, inventory levels, and accounts receivable.

Which Businesses Can Use OCF Formula?

-

E-commerce and retail business

-

Service based business

-

Software & technical industries

-

Real Estate

Example of Operating Cash Flow Formula

Using the provided metrics for Orange Technolabs, we calculate the OCF as follows:

-

Operating Income (EBIT): $95,000

-

Depreciation/Amortization: $0

-

Taxes: $5,000

-

Change in Working Capital (ΔWorking CapitalΔWorking Capital): $4,000

Operating Cash Flow (OCF)=EBIT+Depreciation/Amortization−Taxes+ΔWorking Capital OCF=95,000+0−5,000+4,000

OCF=94,000

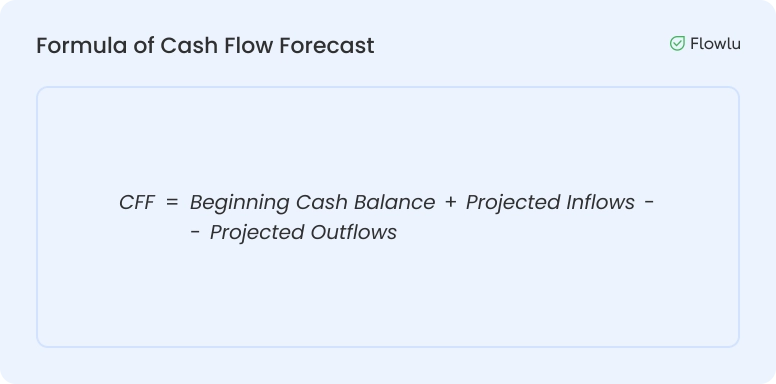

4. Cash Flow Forecast Formula

From the name, you can get an idea that a Cash Flow Forecast is useful for predicting future cash flows. Business professionals can use this formula to determine the amount they will have in the future.

Calculating CFF does not involve any complex terms, and it's quite simple.

-

Beginning Cash: The amount of money a business currently has on hand.

-

Projected Inflows: The expected amount of money the business anticipates receiving from due invoices and other income sources.

-

Projected Outflows: The expenses and payments the business plans to make within the given timeframe.

Which Business Uses Cash Flow Forecast Formula?

-

Transport and logistics

-

Food services and restaurants

-

Agriculture and farming

-

Hospitality and tourism

Example of Cash Flow Forecast Formula

Taking the same example of the above company, Orange Technolabs, we understand the cash flow forecast formula with the following assumed metrics:

-

Beginning cash: $20,000

-

Projected inflows for the next 90 days: $40,000

-

Projected outflows for the next 90 days: $5,000

Then, according to the formula:

CFF=$20,000+$40,000−$5,000=$55,000

This means the company has $55,000 available for the future forecast.

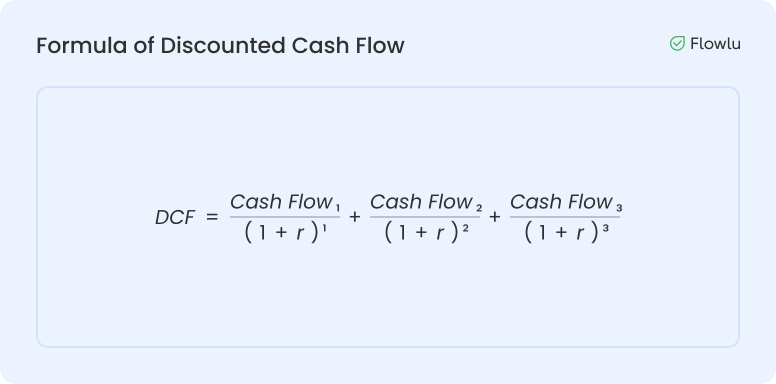

5. Discounted Cash Flow

Discounted cash flow is another formula to predict the business value for the upcoming time. Business owners must manage cash flow for the present and future. You must have proper predictions for the coming year or next quarter instead of being limited to monthly cash flow.

The formula to calculate DCF might seem complex at first glance, but it is essential for predicting the value of future cash flows in today's terms.

Here’s what each term means:

-

Cash Flow1: The expected cash flow in the 1st year.

-

Cash Flow2: The expected cash flow in the 2nd year.

-

r: The discount rate, which reflects the time value of money and the risk of the investment. It should be carefully determined through research and is typically set higher than the inflation rate to account for risk and opportunity cost.

Which Business Can Use Discounted Cash Flow?

-

Private Equity

-

Value Investors

-

Investment Banking

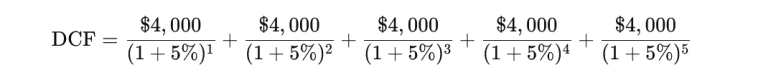

Example of Discounted Cash Flow Formula

For Orange Technolabs, suppose the owner has $10,000 available to invest and expects to receive $4,000 in dividends per year for the next 5 years, with a discount rate of 5%. Using the DCF formula:

Breaking it down:

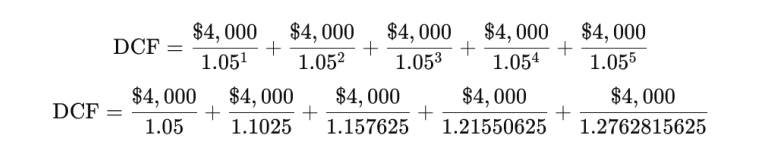

Calculating each term:

-

$4,000/1.05=3,809.52

-

$4,000/1.1025=3,628.11

-

$4,000/1.157625=3,455.35

-

$4,000/1.21550625=3,305.78

-

$4,000/1.2762815625=3,134.60

Summing these values:

DCF=3,809.52+3,628.11+3,455.35+3,305.78+3,134.60=17,333.36

The company's DCF is $17,333.36, which is significantly higher than the initial investment of $10,000. This indicates a positive return on investment and a sound financial decision.

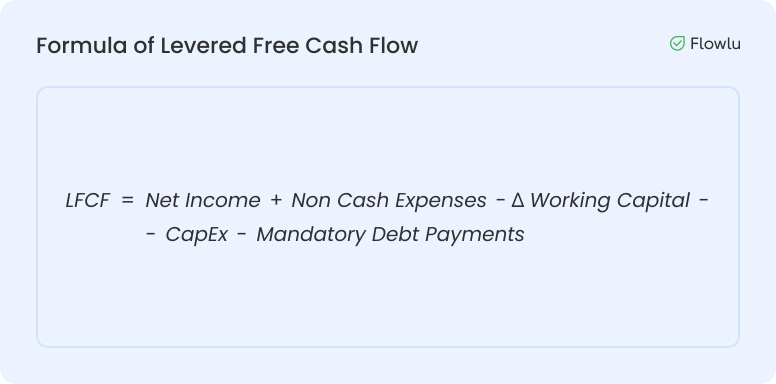

6. Levered Free Cash Flow

When the business borrows any amount in terms of a business loan or anything else, it is called a levered. Leveraged free cash flow is the amount of money that a company holds after paying all debts and obligations.

Here,

- Net Income: The company's profit after all expenses, taxes, and costs have been deducted from total revenue.

- Non-Cash Expenses: These include depreciation and amortization, which are accounting expenses that do not involve actual cash outflows but reduce taxable income.

- Δ Working Capital: The change in working capital, which measures the difference in current assets (like accounts receivable and inventory) and current liabilities (like accounts payable). A decrease in working capital adds cash, while an increase reduces cash.

- Capital Expenditures (CapEx): The funds used by the business to acquire, maintain, or upgrade physical assets such as equipment, machinery, buildings, and property.

- Mandatory Debt Payments: The payments required to meet obligations to lenders, investors, or debtors, such as principal repayments and interest.

Which Businesses Can Use LFC Formula?

-

Utilities and energy

-

Retail chain franchises

-

Capital-intensive industries

-

Private equity firms

Example of Levered Cash Flow

Suppose the owner of Orange Technolabs started the company 2 years ago with $40,000 of their own money and borrowed $20,000 with $1,000 in annual debt obligations. The following metrics are provided for 2 consecutive years:

Year 1

-

Net Income (EBITDA): $120,000

-

CapEx: $110,000

-

Δ Working Capital: $40,000

-

Mandatory Debt Payments: $10,000

Using the above formula:

Calculation for Year 1:

LFCF=120,000−40,000−110,000−10,000LFCF=120,000−40,000−110,000−10,000 LFCF=−40,000LFCF=−40,000

Year 2

-

Net Income (EBITDA): $140,000

-

CapEx: $115,000

-

Δ Working Capital: $20,000

-

Mandatory Debt Payments: $1,500

Calculation for Year 2:

LFCF=140,000−20,000−115,000−1,500LFCF=140,000−20,000−115,000−1,500 LFCF=3,500LFCF=3,500

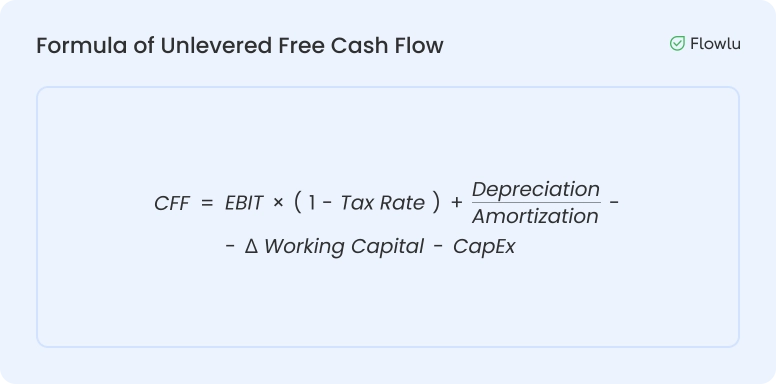

7. Unlevered Free Cash Flow Formula

Unlevered free cash flow is a key metric for a business that analyzes the company’s cash flow before accounting for interest payments. It showcases the ability of the company to generate payments from its core operations.

When the company accounts without any interest payment, that cash flow is known as unlevered free cash flow. In other words, we can say it is the amount remaining to the company after paying capital and operating expenses. UFCF provides a clear comparison of cash flow for multiple businesses.

Which Businesses Can Use UFCF?

-

Bankers and Investors

-

Pharmaceuticals

-

Technological companies

-

Farming

Example of Unlevered Cash Flow

Considering the same example Orange Technolabs in Levered Cash Flow, we suppose following metrics:

Year 1

-

EBIT: $120,000

-

Taxes: $20,000 (Tax Rate = 20,000120,000=16.67%120,00020,000=16.67%)

-

CapEx: $110,000

-

Δ Working Capital: $40,000

-

Depreciation/Amortization: $0 (not provided, assumed $0)

Calculation for Year 1:

UFCF=120,000×(1−0.1667)+0−40,000−110,000

UFCF=120,000×0.8333−40,000−110,000

UFCF=99,996−40,000−110,000

UFCF=−50,004

Year 2

-

EBIT: $140,000

-

Taxes: $3,500 (Tax Rate = 3,500140,000=2.5%140,0003,500=2.5%)

-

CapEx: $115,000

-

Δ Working Capital: $20,000

-

Depreciation/Amortization: $0 (not provided, assumed $0)

Calculation for Year 2:

UFCF=140,000×(1−0.025)+0−20,000−115,000

UFCF=140,000×0.975−20,000−115,000

UFCF=136,500−20,000−115,000

UFCF=1,500

Why Is It Important to Calculate Cash Flow?

Calculating cash flow is a valuable process for all businesses. Here are some points to prove the value of cash flow calculations.

- Hassle-Free Operation: Good financing cash flow is an indication that the company can pay its payroll and other expenses on time. Thus, calculating cash flow is very important.

- Helpful in Decision-Making: Any decision related to launching a new product or taking on new subsidiaries depends on cash flow. If there is good cash flow, it will be convenient for professionals to make decisions.

- Risk Management: Managing risk is easier with cash flow management because it conveys a clear landscape of the business's financial health. It also indicates the ability of a business to cover expenses and debt obligations.

- Managing Tax: Proper cash flow is also helpful in managing tax planning while ensuring that enough funds are available to pay tax returns.

Tips for Effectively Managing Your Business Cash Flow

Adopt the Best Invoice Process

Keeping invoices at the top is the best trick for managing your business's cash flow. On-time payment is like a lifeline for any business, and to keep this lifeline active, you need an invoice. It's better to create and send invoices using all-in-one tools like Flowlu (that includes online invoicing) or invoice software like Moon Invoice to enhance on-time payment.

To boost your on-time payment, you can also adopt the following tips:

-

Offer multiple payment options to the client.

-

Mention all the payment terms in clear language and highlight them.

-

Send payment reminders to the customer before the due date.

-

Be open to accepting partial payments.

Keep Checking Expenses and Cut Down the Same

Every business has expenses, whether large or small. However, businesses need to keep auditing and managing their expenditures. This helps to eliminate unfavorable expenses that negatively impact cash flow.

Below are some tricks to reduce expenses:

-

Optimize inventory management.

-

Apply automation where possible to reduce the expenses associated with traditional processes.

-

Try to liquidate old resources in the inventory.

Verdict

Every business must identify cash flow and manage it. However, accuracy can only be determined when you choose a cash flow calculator. In the beginning, it may be tough, especially for small business owners. However, once you get familiar with the concept, you will easily know the approach to calculating cash flow.

Net income and cash flow are both financial metrics but are different in the following ways:

- Net income is calculated by subtracting expenses from revenue, whereas cash flow is calculated by using a cash flow formula based on the in and outflow of cash.

- Net income is calculated on an accrual basis, whereas cash flow reflects actual cash transactions in real-time.

- The use of cash flow is for assessing liquidity and managing debt whereas net income is helpful to assess profitability and evaluation of long-term growth.

You need to follow the below strategy to forecast your cash flow:

- Determine the business goal

- Select the period

- Selecting the forecasting method

- Find out the total cash inflow and total cash outflow

- Utilize cash flow projection software

To enhance cash flow management:

- Optimize invoice processing with tools like Flowlu or Moon Invoice.

- Regularly audit expenses and cut unnecessary costs.

- Automate processes where possible.

- Offer flexible payment terms, such as partial payments or multiple payment options.

- Monitor inventory and liquidate excess stock.

By following these steps, you can maintain a healthy cash flow and support business growth effectively.