Top 8 Financial Management Tools for Small Businesses

But why go through it all alone when financial management tools can make your life easier? Small businesses using these tools are twice as likely to improve efficiency and reduce making any costly mistakes. This is because these systems can handle budgeting, invoicing, and even compliance, which gives you more time to focus on growing your business.

With so many options out there, though, how do you figure out which tool works best for your operations and workflow? That’s why we’re listing down top financial management tools for different operations that work best for small businesses. We will be covering everything from expense tracking to payroll. So, whether you’re just starting out or scaling up, our list can help you narrow down on your options and make a calculative decision for your business! Let’s get started.

Why Small Businesses Need Financial Management Tools

1. They Save You Time

No one starts a business because they love reconciling bank statements. Tasks like these take hours and pull you away from focusing on strategy or growth. Financial management tools step in to automate these mundane processes, making them faster and less error-prone. Whether it’s auto-generating invoices or streamlining payroll, these tools help lighten the load so you can put your energy where it counts.

2. They Help You Avoid Costly Mistakes

Even the sharpest among us can make mistakes. A single misplaced decimal or forgotten expense deduction can lead to financial headaches—or worse, hefty penalties. Financial tools significantly lower the chances of human error by automating calculations and syncing data in real time. The result? Peace of mind knowing your numbers are accurate, and your books are in good shape.

3. They Make Growth Easier

Growth is exciting but comes with its own challenges. Managing a larger volume of transactions or adding new revenue streams can quickly become overwhelming without the right systems in place. Financial management tools are designed to scale with your business. They handle the increased complexity seamlessly, giving you a solid financial foundation as you expand.

4. They Give You Real-Time Data

Decisions are only as good as the data behind them. Financial tools give you instant access to crucial metrics like cash flow, profit margins, and outstanding invoices. With these insights at your fingertips, you’re instantly better equipped to make informed calls, be it doubling down on a successful strategy or pausing a risky venture.

5. They Simplify Tax Season

Tax season is stressful enough without having to dig through piles of receipts or decipher complex regulations. Financial management tools simplify this process by keeping all your records organized and generating tax-ready reports. This not only saves time but also reduces the chances of penalties or audits.

6. They Build Trust

How you manage money says a lot about your business. Sending invoices on time shows clients you’re dependable, while accurate payroll makes your team feel valued. Financial tools help you build trust with the people who matter most by keeping your operations smooth and professional. And in today’s competitive market, that trust can set you apart.

What to Look for in Financial Management Tools

With so many options on the market, narrowing down the right tool can feel overwhelming. But the best tools share a few features that make managing your finances simpler and more efficient. Here’s what to prioritize:

User-Friendly Design with Scalability

Your financial tool should work for you, not the other way around. An intuitive, easy-to-navigate interface saves you time and reduces frustration, especially during the learning curve. But don’t just think about now. Make sure to choose a solution that grows with your business, adapting to higher transaction volumes or more users as you expand.

Integrates Easily and Updates in Real-Time

Nobody has time to manually input data into multiple systems. Find a tool that connects seamlessly with the software you’re already using, like your CRM, e-commerce software, or ERP. Real-time syncing is just as critical, as this ensures that the numbers you’re looking at are always up-to-date and ready for action.

Security You Can Trust

Your financial data isn’t just numbers, it’s the backbone of your business. So, make sure to choose a tool with strong security measures like encryption, multi-factor authentication, and compliance with regulations like GDPR or CCPA. This is because peace of mind is priceless when it comes to protecting sensitive information.

Customizable with Clear Reporting

Every business is different. A good tool should let you customize dashboards, workflows, and reports to fit your specific needs. And speaking of reports, try to go for a solution that doesn’t just throw raw data at you. Insightful, visual dashboards and easy-to-read analytics can make your job easier by helping you make smarter decisions quickly.

Mobile Access and Great Support

Running a business doesn’t stop when you leave the office. A mobile-friendly tool lets you check reports, approve invoices, or manage payroll from anywhere. And if something goes wrong? Responsive customer support (whether via live chat, email, or phone) can make all the difference.

Transparent Pricing That Matches Value

Affordability matters, but not at the cost of quality. Avoid tools with hidden fees and focus on solutions that deliver clear value for their price. The right tool should feel like an investment in your business’s growth and not just another monthly expense.

By keeping these features in mind, you’ll find a financial management tool that simplifies your processes, saves you time, and grows with your business.

Categories of Financial Management Tools for Small Businesses

Different tools address specific financial needs, so understanding their categories will help you find the best fit for your business. Below is a detailed look at key types of tools, our top picks, and a few alternatives worth considering.

1. Invoicing and Payment Processing

Efficient invoicing tools help you with timely payments, streamline billing, and reduce the hassle of managing administrative tasks.

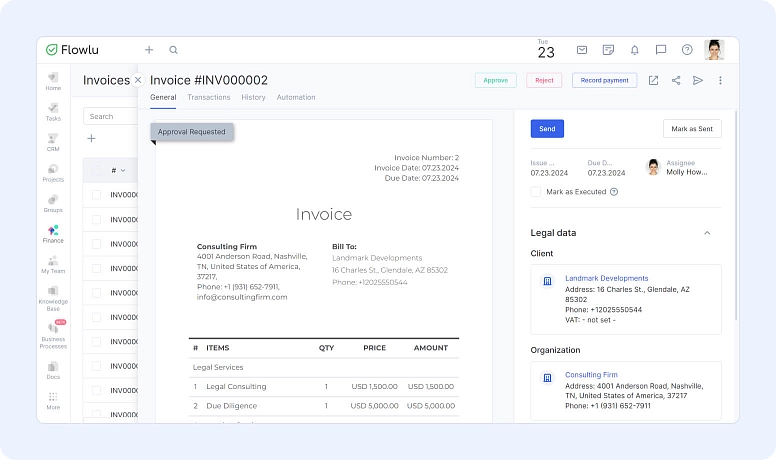

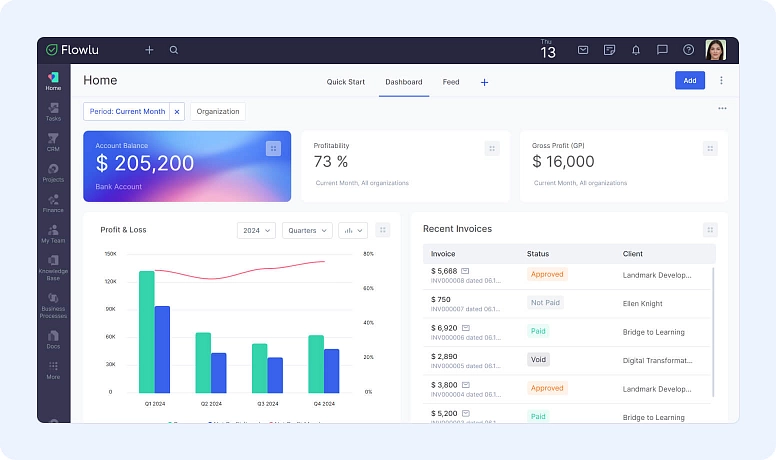

Our Top Pick: Flowlu

Why It Stands Out: Flowlu simplifies invoicing with templates, automation, payment tracking, and integration with popular payment gateways, making it a one-stop shop for invoicing needs.

Key Features:

- Customizable invoice builder to create professional invoices.

- Automated payment reminders for overdue invoices.

- Seamless integration with multiple payment platforms.

- Recurring invoices and workflow automation to save time.

- Billable time tracking with direct invoicing for clients.

Pricing: Starts at $39/month.

Best For: Service-based businesses and freelancers.

Other Alternative Tools to Explore:

- FreshBooks: Loved for its intuitive design.

- Zoho Invoice: A budget-friendly option for smaller teams.

2. Budgeting Tools

Budgeting tools are your financial roadmaps, helping you allocate resources effectively, track cash flow, and prepare for potential challenges.

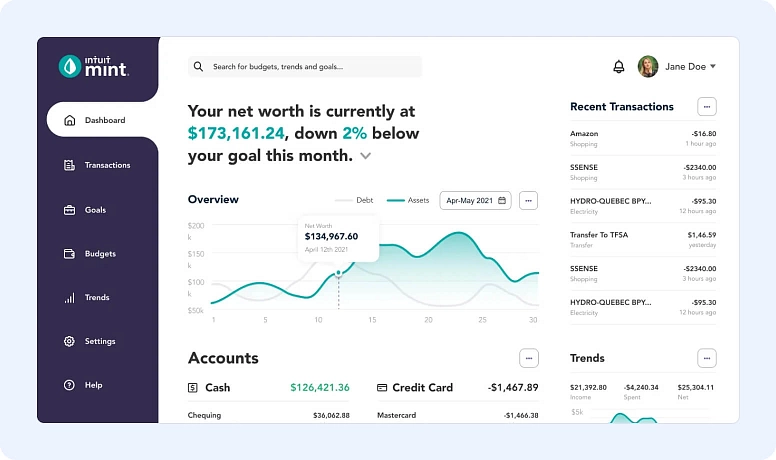

Our Top Pick: Mint

Why It Stands Out: Mint makes budgeting simple with automated transaction tracking, personalized alerts, and real-time insights into your spending habits.

Key Features:

- Automatically categorizes income and expenses.

- Provides budget alerts to help you avoid overspending.

- Syncs effortlessly with bank accounts and credit cards.

Pricing: Free with optional premium upgrades.

Best For: Freelancers, solopreneurs, and businesses working with tight budgets.

Other Alternative Tools to Explore:

- YNAB (You Need A Budget): Ideal for zero-based budgeting.

- PocketGuard: Helps businesses stay within their spending limits.

3. Accounting Software

Accounting tools handle bookkeeping, tax preparation, and financial tracking, helping you stay organized and compliant.

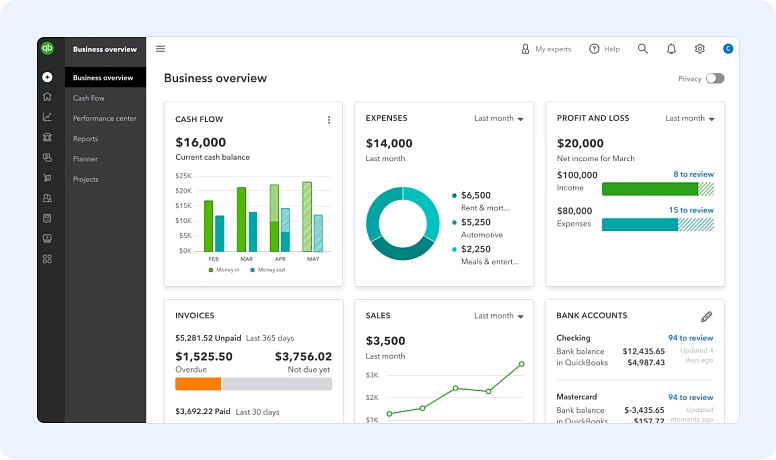

Our Top Pick: QuickBooks

Why It’s a Top Choice: QuickBooks offers a complete suite of features, from tracking expenses to tax preparation, making it an all-rounder for small businesses.

Key Features:

- Tracks income and expenses in real-time.

- Automated tax compliance and preparation.

- Generates detailed financial reports to monitor performance.

Pricing: Starts at $35/month.

Best For: Retailers, startups, and professional services.

Other Tools to Explore:

- Xero: Great for businesses needing multi-currency support.

- Wave: A free solution for small teams.

4. Expense Tracking

Tracking business expenses is easier with tools designed to handle receipts, reimbursements, and approvals efficiently.

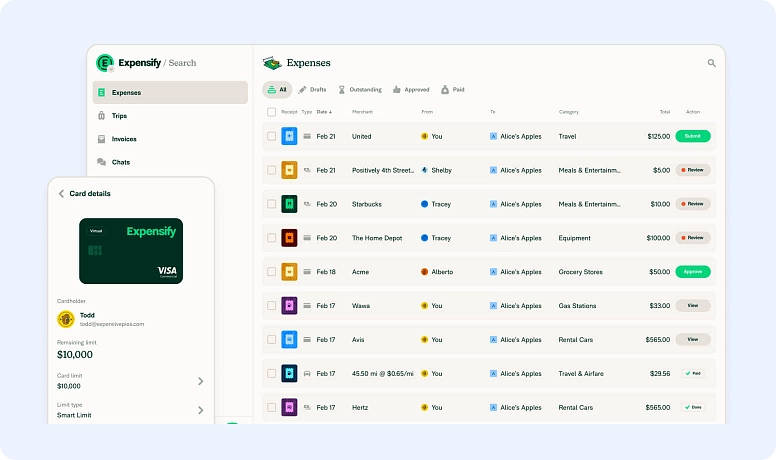

Our Top Pick: Expensify

Why It Works: Its receipt scanning and smart categorization streamline expense reporting for teams.

Key Features:

- SmartScan automatically categorizes receipts.

- Built-in approval workflows for team expenses.

- Integrates with popular accounting platforms like QuickBooks and Xero.

Pricing: Starts at $5 per user/month.

Best For: Teams with traveling employees or frequent expense submissions.

Other Tools to Explore:

- Flowlu: Great for tracking expenses in project-based work.

- Zoho Expense: A budget-friendly choice for small businesses.

- SAP Concur: Ideal for larger businesses with complex expense workflows.

5. Payroll Management

Payroll software takes the complexity out of paying employees while ensuring compliance with labor laws and tax regulations.

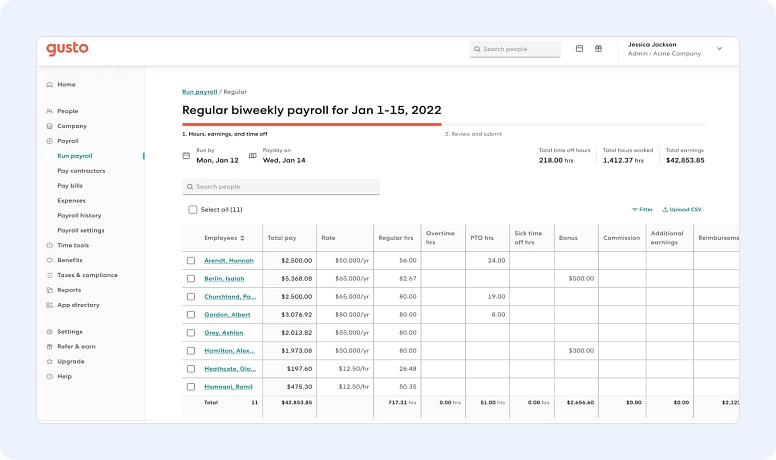

Our Top Pick: Gusto

Why It’s Loved: Gusto combines easy payroll automation with employee benefits management in a user-friendly interface.

Key Features:

- Automatically calculates and files payroll taxes.

- Manages employee benefits like health insurance.

- Offers time-tracking integration.

Pricing: Starts at $40/month + $6 per employee.

Best For: Growing teams needing both payroll and HR management.

Other Tools to Explore:

- ADP Run: Comprehensive for payroll and HR integration.

- Paychex Flex: Scales well with growing businesses.

6. Loan Management

If your business manages loans or offers customer financing, loan management tools are a must-have.

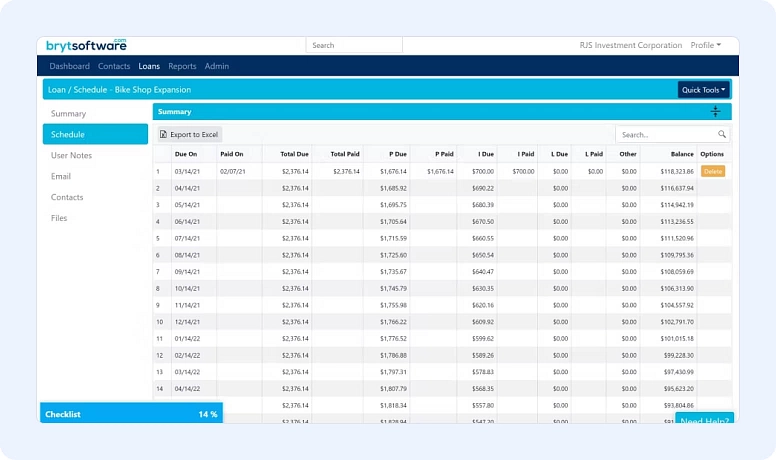

Our Top Pick: Bryt Software

Why It’s Essential: Bryt automates loan servicing and provides real-time reporting, making it a go-to tool for lenders.

Key Features:

- Automates payment schedules and reminders.

- Provides in-depth loan performance analytics.

- Modular design for easy customization.

Pricing: Custom pricing, starting from $59/month

Best For: Automotive dealers, lenders, and businesses offering financing.

Other Alternatives to Consider:

- LoanPro: Comprehensive suite of features ideal for lenders with high loan volume.

- Mortgage Automator: Tailored for mortgage lenders.

7. Financial Reporting

These tools transform raw data into actionable insights with easy-to-read dashboards and reports.

Our Top Pick: Fathom

Why It’s Useful: Fathom delivers detailed, visually appealing financial reports that help with strategic planning.

Key Features:

- Tracks customizable KPIs tailored to your business.

- Offers cash flow forecasting to support growth.

- Consolidates reports for businesses with multiple entities.

Pricing: Starts at $50 / month + $50 per extra company.

Best For: Growing businesses focused on data-driven decisions.

Other Tools to Explore:

- Klipfolio: Great for real-time dashboard visualizations.

- Tableau: Offers advanced analytics for more complex data needs.

8. Pay Stub Generation

Creating accurate pay stubs is essential for financial transparency and compliance with tax regulations.

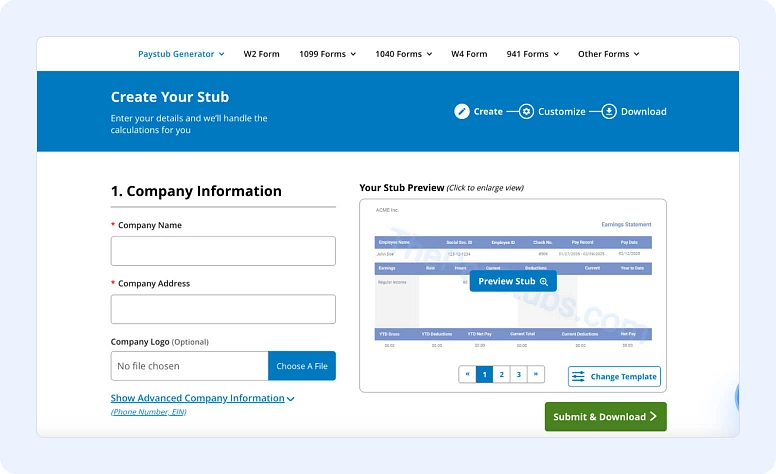

Our Top Pick: ThePayStubs

Why It’s Loved: ThePayStubs simplifies pay stub generation with an intuitive interface, ensuring accuracy and legal compliance.

Key Features:

- Generates professional pay stubs and W-2 forms instantly.

- Customizable templates for different business needs.

- Secure storage and easy access to records.

Pricing: Starts at $8.99 per pay stub.

Best For: Small businesses, freelancers, and independent contractors needing quick and reliable pay stub solutions.

Other Tools to Explore:

- PayStubCreator: Customizable pay stubs with tax calculations.

- PayStubs.net: Easy-to-use interface with instant download options.

How to Choose the Right Financial Management Tool

Picking the right financial management tool can make a huge difference in your business’s growth, efficiency, and financial health. But with so many options out there, finding the right one goes beyond just ticking off features. You also need to find the tool that aligns with your goals and addresses your unique challenges. Here’s a practical guide to help you make the best decision:

1. Understand Your Business Needs

Start by asking yourself, “What’s slowing me down right now?” Are unpaid invoices piling up? Are expense reports chaotic? Pinpointing your pain points is the first step toward narrowing down your options.

For example:

- If payroll mistakes are a constant headache, consider tools like Gusto to automate calculations and filings.

- If tracking project expenses feels like a guessing game, tools like Flowlu can make your life easier.

Pro Tip: Choose tools that not only fix today’s problems but also grow with your business. What works for a one-person team might not cut it as your operations expand.

2. Weigh Costs Against Value

Your budget is a major factor, but it’s not just about finding the cheapest option. Look for tools that provide real value for their cost.

For example:

- A freelancer might thrive with free tools like Wave, while a growing business might need to invest in QuickBooks for its more advanced features.

- Watch out for hidden costs, like onboarding fees or extra charges for integrations.

Pro Tip: Think long-term. Spending a little bit more upfront on the right tool can save you time and money down the road.

3. Try Before You Buy

Never commit to a tool without testing it first. Most financial software offers free trials or live demos. Use them to see how well the tool fits your workflow.

Pay attention to:

- Ease of use: Can you navigate the interface without needing a manual?

- Performance: Does it handle your data quickly and accurately?

- Relevance: Are the features practical, or does it feel overloaded with unnecessary options?

Pro Tip: If your team will be using the tool, get their input during the trial. Their feedback is essential for smooth adoption.

4. Check Compatibility With Your Current Systems

Your financial tool shouldn’t exist in a bubble. It needs to work well with what you already use. For example, if you have HubSpot as your CRM or use Xero for accounting, make sure the tool connects easily—or think about an all-in-one platform like Flowlu, which combines CRM, project management, financial management, and invoicing under one roof.

Why integration matters:

- Cuts down on manual data entry (and the errors that come with it).

- Keeps your workflows smooth and uninterrupted.

- Saves time when switching between systems.

Pro Tip: If you have a custom-built platform, look for tools that offer API integrations. This flexibility can be a game-changer.

5. Prioritize Reliable Customer Support

Even the best tools come with a learning curve. Having dependable customer support can make a big difference, especially during setup or troubleshooting.

What to look for:

- Availability: Are they there when you need them?

- Support channels: Do they offer live chat or phone support, or just email?

- Resources: Is there a well-stocked help center or active user community?

Pro Tip: Check reviews or forums to see what real users say about their support experience. A company that responds quickly and solves problems efficiently is worth its weight in gold.

6. Focus on Security

When it comes to handling financial data, security is non-negotiable. The right tool should protect your information with industry-standard protocols like encryption and multi-factor authentication.

Pro Tip: If your business operates in a regulated industry, make sure the tool meets specific compliance requirements, such as SOC 2, GDPR, or others relevant to your business.

Conclusion

Choosing the right financial management tool gives your business the resources to thrive. By understanding your needs, balancing cost with value, and testing tools before committing, you’ll find one that simplifies your work, saves time, and supports your growth.

Remember, the best tool isn’t just about meeting your current needs—it’s about growing with you, integrating seamlessly into your workflows, and offering reliable support when you need it most.

Take your time to choose wisely. The right tool isn’t just an expense; it’s an investment in your business’s future. Make it count. Try Flowlu with a free trial and see how it fits your business needs.

It depends on what you need. If you want everything in one place—CRM, project management, invoicing, and financial tracking—Flowlu is a solid choice. If budgeting is your focus, Mint keeps things simple. For accounting, QuickBooks is a popular option.

They take care of the boring stuff—like sending invoices, tracking expenses, and handling payroll—so you don’t have to. Many of them also connect with the apps you already use, which means less manual work and fewer mistakes.

Most good ones use encryption, secure logins, and follow privacy laws. But it’s always worth checking their security policies to make sure your data stays protected. Look for things like two-factor authentication and compliance with industry standards.