Navigating Small Business Finances in the Digital Age

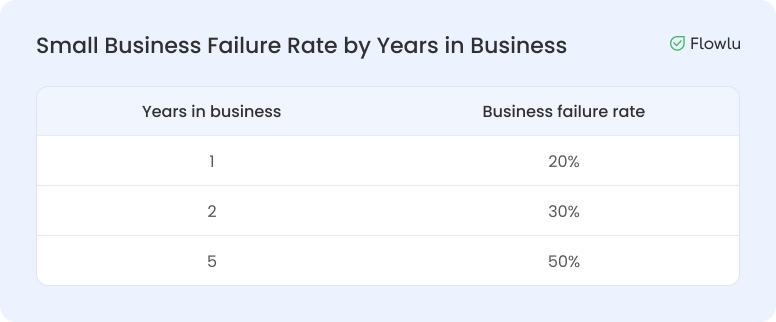

Here’s the catch: The United States has 33.3 million small businesses, comprising 99.9% of all companies across the country. However, research reveals that one in five fail during the first year, 30% in the second year, and 50% in their fifth year.

As a small business owner, you should manage your finances well. What better way to ensure this than to leverage online tools and technologies in today’s digital landscape?

Don’t worry; This page focuses on financial management for startups and small enterprises. Read on to learn how to navigate your small business finance in the digital age.

The Impact of Digitalization on Small Business Finance

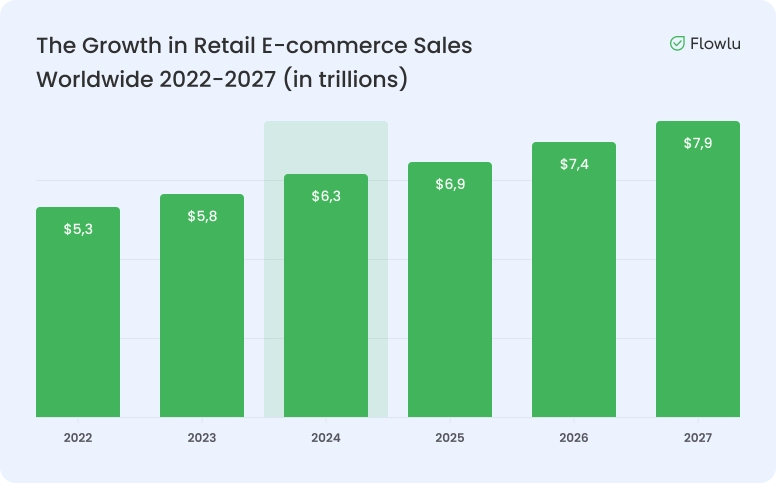

There’s no denying how businesses operate and consumers transact in today’s digital landscape. Think of the rise of e-commerce triggered by the pandemic and projected to hit $6.3 trillion this year. Even brick-and-mortar stores must establish their online presence and transition to click-and-order stores.

Digital transformation is crucial in various industries, especially in financial management. And this applies all the more to small businesses looking to grow and succeed. Nearly half have already adopted a digital transformation strategy.

As the name suggests, digital transformation is about transforming how your business operates by leveraging online tools and technological resources. However, it's more than just investing in technologies; it's also about taking control of your business's future.

According to McKinsey, digital transformation is a "long-term effort to rewire how an organization continuously improves and changes" since technology is now integrated into business while constantly evolving.

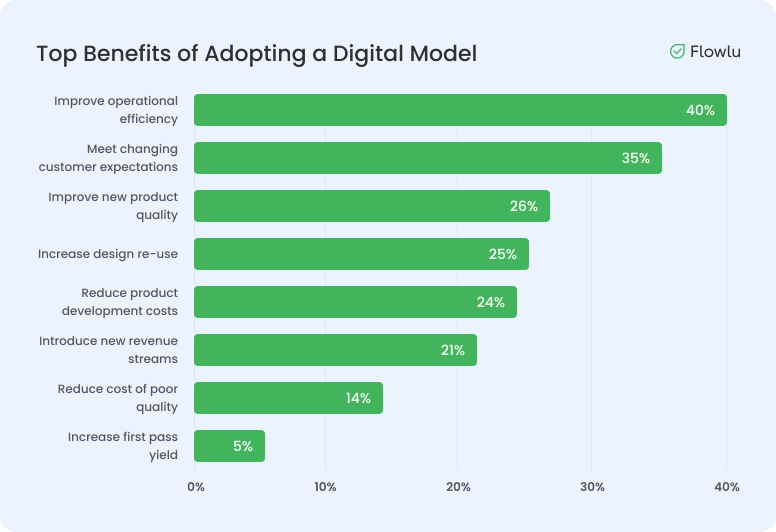

Generally, the benefits of adopting a digital model are multifold, such as improved operational efficiency, met customer expectations, and improved product quality:

As such, consider investing in financial technology (FinTech). Here’s why you should capitalize on digitalization for your small business finance:

-

Increased work efficiency: FinTech automates several financial processes and removes manual tasks. Think of automated payroll accounting for employee salary calculation and cloud invoicing for vendor billing. They can increase your efficiency, translating to a boost in productivity.

-

Ensured data accuracy: Financial management should have no room for errors and mistakes. FinTech, such as automation and artificial intelligence (AI), helps ensure complete bookkeeping and accurate financial analysis. That way, you can avoid accounting errors and payroll disputes.

-

Enhanced customer satisfaction: FinTech aids in managing consumer data and tracking finances. Consider the use of CRM systems for maintaining customer information and relationships. While at it, you can seamlessly manage the profits you receive from them. Additionally, integrating call center AI can further enhance the customer experience by automating responses, reducing wait times, and providing personalized support, all of which contribute to building stronger relationships and increasing customer satisfaction.

-

Maintained cash flow: Financial management aims to achieve these goals: decreased expenses and increased income. FinTech helps you monitor and manage your expenditures and sales for a consistent cash flow. Think of using Flowlu to avoid cash gaps in your payment calendar.

-

Guaranteed legal adherence: FinTech helps small businesses comply with laws and regulations. Software automation and data analytics, for instance, let you optimize your tax reporting and analysis, respectively. This helps you avoid legal implications and financial losses.

Learn practical ways to manage your small company’s finance in the digital era.

How To Manage Your Small Business Finance in the Digital Landscape

Companies and organizations should consider the key elements for short- and long-term financial management. Digital tools and FinTech solutions can help, which applies to small businesses as well. They can streamline financial workflows and optimize financial operations.

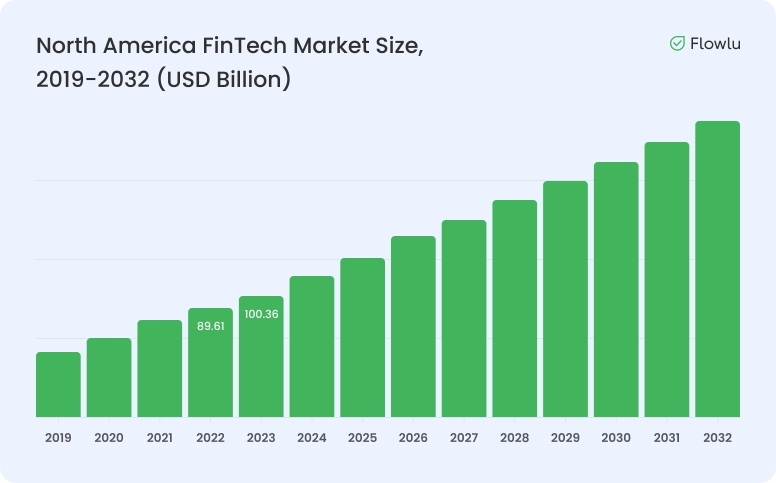

Fortune Business Insights predicts the global FinTech market will grow from $340.10 billion in 2024 to $1.152 trillion by 2030 at a compound annual growth rate (CAGR) of 16.5.0%.

FinTech companies provide financial solutions, tools, and platforms to business-to-business (B2B) enterprises. As a small business, capitalize on the industry’s market growth and invest in digital tools and technologies for financial management. Here’s how:

1. Invest in digital tools and technologies for financial management

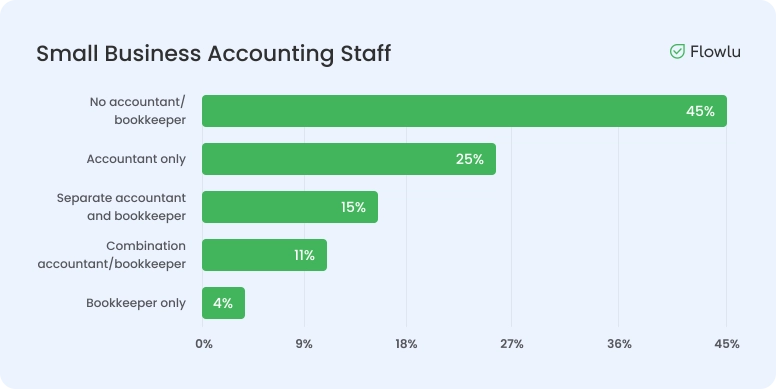

Did you know that some small businesses still lack accounting resources? About a quarter still use pen and paper for bookkeeping and accounting instead of using computers. What they fail to realize is how technologies can help optimize their financial operations.

Schwartz suggests the following FinTech solutions:

-

Software automation: Automate several financial functions, such as bookkeeping, accounting, tax reporting, and more. Automated software can help get rid of manual tasks and speed up processes for your small business. Ultimately, automation will streamline financial operations, thus boosting your overall efficiency and productivity.

-

Artificial intelligence: Harness the power of AI, the simulation of human intelligence into online tools and platforms. You can leverage AI chatbots and virtual assistants for your small business’s order fulfillment and customer service. Likewise, you can use AI for financial analysis.

-

Customer relationship management: Consider utilizing CRM systems best suited for startups and small businesses. CRM platforms are best for managing customer relationships. But while at it, they can help you record, organize, and analyze their financial transactions.

-

Data analytics: Tap into analytic tools powered by AI for financial management. They use machine learning (ML) and deep learning (DL) to learn from datasets and make decisions with limited human intervention. They can aid in financial planning, sales forecasting, and business reporting for your small business.

-

Blockchain: This technology is a digital ledger capable of recording financial data known for its encryption, security, immutability, and decentralization. Use smart contracts to collaborate with contractors, vendors, and partners. While at it, use AI contract review software for your small business.

2. Leverage FinTech for consumers’ financial transactions

The use of digital tools and FinTech solutions doesn’t only apply to your employees. You can leverage them for your much-valued consumers. Most customers now pay using various payment methods, as we’re going digital and heading towards a cashless society.

Jim Pendergast, Senior Vice President at altLINE Sobanco, suggests offering consumers digital tools and FinTech solutions. "These technologies not only help your professionals manage finances but also assist customers in making purchases. They make the customers' financial transactions much easier, faster, and more convenient."

Pendergast recommends providing the payment options below:

-

Online banking options: It's better not to limit your small business's payment methods. Accept payment options such as credit cards, debit cards, wire transfers, electronic checks, mobile wallets, and cryptocurrencies from customers. However, secure your payment gateways for financial protection.

-

Mobile payment apps: As most customers heavily rely on their mobile devices, allow the use of apps, such as PayPal, Block (Square), and Cash App, for consumer transactions. They allow your customers to do business and transact with you online using their cellphones and other devices.

-

Digital wallets: They are exactly what they sound like—wallets for keeping money but online. Let your stakeholders, whether customers or employees, use digital wallets for financial transactions. They allow them to receive salaries, make payments, and transact online seamlessly and efficiently.

-

Crypto apps: Businesses, including startups and SMEs, can no longer ignore the rise of digital currencies. As such, start accepting cryptocurrencies for your small business in today's digital world. Let customers use crypto apps to manage cryptos like Bitcoin (BTC) and Ethereum (ETC). They can keep their digital assets and transact with you via blockchain technology.

3. Stay on top of cybersecurity for financial protection

Cybersecurity has become a growing concern in business. However, online startups and small companies can be the most vulnerable to cyberattacks. About 43% of cyber attacks target small businesses, but only 14% are ready to protect themselves.

Unfortunately, cyberattacks can lead to financial losses. Below are forms of cyberattacks to be wary of:

-

Password attack - password getting stolen for access to systems, network, and data

-

Phishing attack - deceiving people to provide sensitive data, usually via email

-

Malware attack - malicious software used to harm computers, systems, or networks

-

Denial of Service attack - disrupting systems or networks deliberately

-

Man-in-the-middle attack - stealing data by intercepting communication between two parties

As such, small businesses must prioritize cybersecurity to avoid financial losses and legal ramifications. They should do what it takes to prevent and protect themselves from cyberattacks. Here's how:

-

Choose reliable tools or platforms. When looking for FinTech solutions, opt for secure websites or work with trusted service providers like Surfshark for VPN while accessing third party websites or password authenticators, and a few more. They can make your systems and networks less susceptible to cyberattacks.

-

Protect payment gateways. Not only should you invest in reliable payment portals, but you should also audit them regularly. That way, you can identify vulnerability points and secure them altogether.

-

Set up HTTPS and SSL. Incorporate Hypertext Transfer Protocol Secure (HTTPS) and Secure Sockets Layer (SSL) into payment processing features. These website protocols promote network security and data privacy between your small business platform and customers.

-

Require strong authentication. Setting multi-factor authentication (MFA) for customers and employees accessing the database is best. For example, ask for card verification value (CVV), one-time password (OTP), and biometric data from customers to regulate access.

-

Leverage monitoring and detection tools. Free fraud detection resources and tools are available for startups and small businesses. Take advantage of them to monitor your systems and identify potential cyber threats so you can immediately act upon them.

4. Work with finance professionals using digital platforms

Most entrepreneurs don't see the need to employ finance professionals for their small businesses. The same Clutch report reveals nearly half of them (45%) don't hire a bookkeeper or an accountant. They fail to realize that finance experts can help them manage finances and grow their money.

Gerald Lombardo, Head of Growth at Popl, however, suggests hiring finance professionals adept at using FinTech solutions. "Some of the best accountants use software tools and apps to handle routine, repetitive financial work. That way, they can focus on core functions, such as maintaining cash flow, reducing taxes, and growing money."

When hiring finance professionals for your small business, you have the option to outsource or employ the following:

-

Bookkeepers: They are responsible for recording all your business's financial transactions. The goal is to ensure accurate, complete, and up-to-date financial records. Digital tools can help with automatic recording and reporting.

-

Accountants: Not only do they record your financial transactions, but they also manage and analyze them. The goal is to maintain your cash flow and manage your small company's financial health. As cited, software automation can aid in financial planning, analysis, and management.

-

Tax specialists: They handle your small business taxes, from federal and state income taxes to sales taxes. They seek to comply with your tax obligations to ensure full legal adherence. FinTech solutions can help you stay on top of tax recording and filing.

5. Stay up-to-date with laws through online research

Entrepreneurs must adhere to laws and regulations governing their small businesses. Full compliance is one way to maintain your financial health. On the contrary, non-adherence can lead to hefty penalties and even a business shutdown.

Anthony Martin, Founder and CEO of Choice Mutual, underscores the value of FinTech solutions for legal and regulatory compliance. "Digital tools and technologies, for example, can safeguard your business network and ensure the security of consumer data. That's why even small businesses should consider investing in these technologies."

Martin highlights some of the laws and regulations to consider for small businesses:

-

Consumer protection laws: As a small business, you must always protect consumer data and promote customer rights. For instance, consider compliance with the payment card industry data security standard (PCI DSS). PCI DSS is a set of rules for handling payment transactions to keep them as safe as possible. Also, many individuals rely on identity theft protection services to keep their personal information secure, but not every service is right for everyone. If you’re exploring your options, there are options such as Aura or Aura alternatives worth considering.

-

Employment laws: As an entrepreneur, you might employ some workers for your small business. Prioritize legal matters, such as the Fair Labor Standards Act (FLSA), Occupational Safety and Health Act (OSHA), and Worker's Compensation. FinTech solutions can help you manage payroll and finance-related functions.

-

Tax regulations: Taxes are vital in business, even for startups and small companies. Stay on top of your sales tax, federal income tax, and state income tax, among others. Leverage software tools or apps for seamless and efficient tax recording, filing, and reporting.

Final Words

Robust financial management is crucial to business growth and long-term success. But in today's digital landscape, there's a need to capitalize on Fintech. As such, consider the practical tips for navigating your small business finance.

Invest in digital tools and technologies for financial management and consumer transactions. Likewise, promote cybersecurity to ensure financial protection. Finally, hire finance professionals and comply with laws and regulations.

With all these, you can navigate your small business finance in the right direction—ultimately towards business growth and success!

Robust financial management is crucial for startups and small businesses as it ensures financial stability, facilitates growth, and mitigates the risk of failure.

Research indicates that one in five small businesses fail during their first year of operation.

Adopting a digital transformation strategy for small businesses can lead to improved operational efficiency, better customer satisfaction, and enhanced product quality.

FinTech can benefit small businesses by increasing work efficiency, ensuring data accuracy, enhancing customer satisfaction, maintaining cash flow, and guaranteeing legal adherence.

Small businesses can protect their finances by choosing reliable tools, securing payment gateways, implementing HTTPS and SSL protocols, requiring strong authentication, and leveraging monitoring and detection tools.