8 Effective Ways to Carry International Invoices and Payments

Chief among them is how to handle international invoices and payments effectively.

- Do it well, and you’ll build relationships with customers in distant lands while keeping cash streaming into your company coffers.

- Do it poorly, and you could find yourself struggling with delays, legal issues — or even worse — damaging relationships with the business partners you’ve worked so hard to cultivate.

Whether you're a seasoned exporter or just beginning to explore overseas markets, successfully negotiating cross-border transactions is crucial to growing your business. Below are 8 critical keys for effectively managing international invoices and payments. Read more!

What is an international invoice?

An international invoice is a document used in international trade to bill a buyer (importer) for goods or services sold by a seller (exporter) in another country. International invoices are essential in facilitating easy trans-border transactions. In most cases, it’s helpful when undertaking customs clearance and other trade-related issues.

It serves several important purposes:

- Payment Request: This is how you officially ask your customer to pay for your goods or services.

- Customs Documentation: It helps customs officials know the exact price of goods to calculate duties and taxes.

- Proof of Sale: An international invoice and payment means proof of purchase in a global business transaction between the buyer and the seller.

- Shipping Information: These are general details that explain the shipment in terms of quantity, description of goods shipped, and terms of shipment.

- Legal compliance: It helps the merchant meet regulatory and tax laws due to international trade.

Key components of an international invoice often include:

- Seller's and buyer's contact information

- Invoice number and date

- Description and quantity of goods or services

- Unit price and total amount due

- Currency used

- Value-added Tax (VAT)

- Payment terms and method

- Shipping details (e.g., Incoterms)

- Country of origin of goods

- Any additional charges (e.g., freight, insurance)

Top 5 Common Challenges in Managing International Invoices and Payments

Many challenges come with international invoices and payments. This is mainly because of multiple currencies, taxes, and regulations. Let us dwell upon some of the most pervasive hurdles one comes across:

-

Currency Exchange Rates: Fluctuations in currency rates can majorly impact the amounts you’re paid or expected to pay. As the currency of payment or invoicing weakens or strengthens between the time of invoicing and the time of payment, you may receive more or less than expected.

-

Payment Delays: International invoices and payments typically need 3-5 days for settlement. And again, it depends on which country to which country you’re doing the transfer. So, it’s much longer than domestic and can impact a corporation’s cash flow and financial planning.

-

Multiple Payment Methods: Some customers prefer to make bank transfers, while others use online payment methods. It’s essential to satisfy your customer’s preferred payment choice. However, this story can cause some complexity when reconciling and tracking payments.

-

Varying tax laws and regulations: Value-added tax and import/export laws affect the invoicing system, contrasting how the same is done in another country. If these requirements are not met, there may be consequences(Penalties, fines, or other legal matters)

-

Language Barriers and Miscommunication: When dealing with international invoices, you often communicate with vendors and suppliers from different cultural and linguistic backgrounds. Language barriers and cultural differences can lead to miscommunications, delays in invoice processing, or even potentially souring relationships with your business counterparts.

Moreover, it can be difficult for staff to interpret invoices in different languages, which can increase the chances of errors and inconsistencies.

International Invoices: How to Effectively Handle Them in 2025

1. Understand International Invoice Requirements

Managing international invoices requires an in-depth knowledge of regulations that vary significantly by country.

Here is the breakdown in more detail, not limited to:

A. Required Documentation:

- Commercial Invoice — the primary document that describes the transaction.

- Packing List — a list showing the packages' contents, weight, and dimensions.

- Certificate of Origin —This is required to prove the country of origin for manufactured or processed products.

- Bill of Lading — An evidence of Contract for Carriage and Receipt of Goods Shipped.

- Import/Export Declaration — Official statements to customs about shipped goods.

B. Tax Implications:

- VAT/GST: Many countries require these taxes to be specified on invoices.

- Withholding Taxes: Some countries may ask buyers to withhold a certain payment percentage in the name of taxes.

- Double Taxation Treaties: Understand if any apply to your transaction.

C. Currency Regulations:

- Exchange Control Regulations: Certain countries do not allow the movement of certain currencies.

- Local Currency Requirements: Certain countries require that you invoice in their local currency.

D. Customs Procedures:

- HS Codes: Ensure correct Harmonized System codes for all products. How will your goods be valued for duty purposes?

- Free Trade Agreements: Leverage any applicable FTAs for reduced duties.

2. Use Clear and Detailed Descriptions

Clear product descriptions are vital in handling international invoices and payments. Here's how to improve your descriptions:

- Use standardized product codes beside the written description (e.g., HS codes, SKUs).

- Specify materials, components, and manufacturing processes where relevant.

- Include dimensions, weight, and quantity for physical goods.

- In the case of services, you should provide detailed information on the work, how long it will take, and how far the work extends.

- Avoid abbreviations or industry jargon that may confuse customs officials.

- If applicable, merchants can state the purpose or end-use of the product.

3. Choose the Right Currency

The truth is that the choice of currency can significantly affect your business's bottom line. So, let's consider a few things:

-

Volatility of Exchange Rate: You should research the previous trends of currency exchange and future predictions based on that. Besides, there are different ways to manage the risk of fluctuating exchange rates. You can use forward contracts or options. Depending on your situation, you might combine these strategies to meet your business goals best.

-

Bank Charges: Compare fees for different currencies and payment methods.

-

Customer Relationships: Some buyers may prefer to deal in their local currency.

4. Invest in a POS System for Global Commerce

One of the most daunting hurdles to jump over is managing the nuances of global transactions best. It can be a big ask for retail businesses on Magento with an omnichannel approach and multiple locations in different countries to manage those global transactions easily. Many companies make do with separate systems and workarounds, but that can lead to errors and is not hugely efficient.

The complexities of global commerce are numerous:

- Currency conversion

- Tax compliance across different jurisdictions

- Real-time inventory visibility across multiple countries

These challenges can very quickly become overwhelming as your business scales globally.

To address these challenges, you need the best Point of Sale (POS) system that’s made for global retail. One such solution is Adobe Commerce POS – an all-inclusive system built to suit the needs of international retail.

Implementing a complete POS solution, you can:

- Streamline your global transactions

- Ensure accurate currency conversions

- Maintain tax compliance across different countries

- Gain real-time visibility into your inventory across all locations

The result? Less bumps mean less learning, and you can focus on growing your business vs. managing complex systems. You can turn daunting global commerce management into a competitive advantage with the right POS.

5. State Payment Terms

Practical payment terms are crucial for international cash flow management:

- Advance Payment: Consider requesting partial upfront payments for large orders.

- Credit Terms: If you decide to offer credit, remember to conduct a credit check on your international buyer/s.

- Discounts: Early payment discounts can encourage prompter payments (e.g., 2/10 net 30).

- Late Payment Penalties: You should define interest or fines for late payments.

- Payment Methods: Specify accepted methods and any associated fees.

6. Utilize Electronic Invoicing

Electronic Invoicing (e-invoicing) can do away with many of the challenges faced when dealing with an international supplier. It automates and simplifies the process. Most importantly, there is less manual data entry, which also involves human errors.

Furthermore, e-invoicing businesses will see processing times drop by up to 80%. That reduction enables faster approvals and payments. Besides, paper-based invoices are subject to delivery delays. Yet, merchants can deliver electronic international invoices almost instantly to the recipient, even in another part of the world.

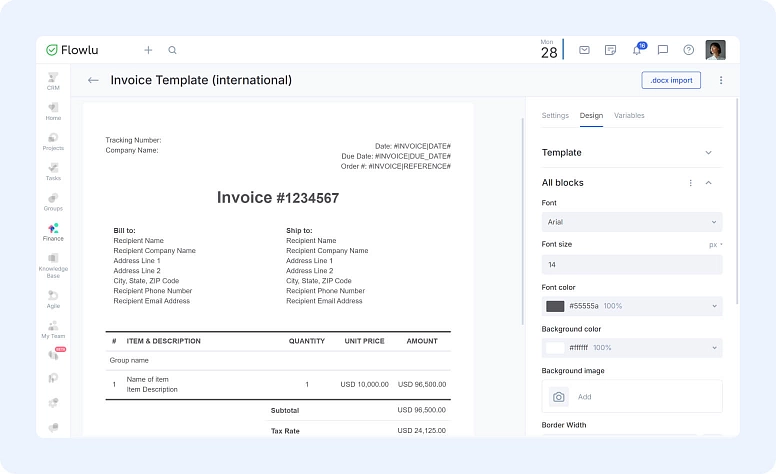

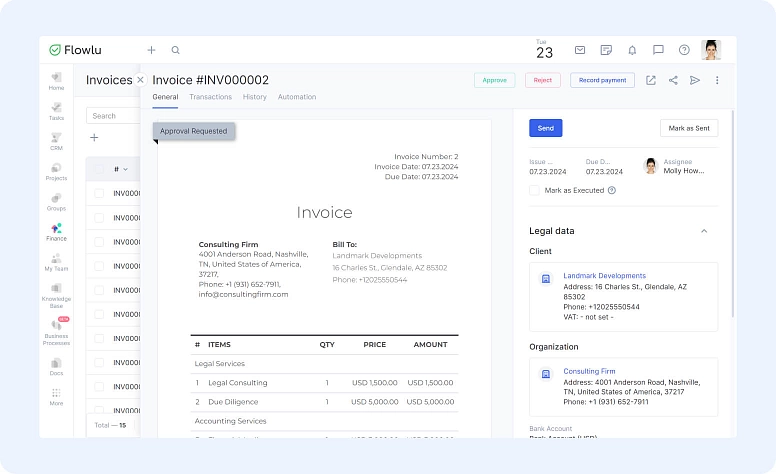

Tips: For businesses that want to simplify their invoicing process, Flowlu has a robust financial management software that uses automated invoicing. They provide businesses with:

- Real-time updates on currency conversion rates

- Quote Invoice Receipt Template that can be customized to support multiple languages

- An ability to integrate with various payment methods seamlessly.

All help organizations streamline their cross-border invoicing processes and reduce the risk of expensive errors. Hence, Flowlu can save you time and effort when creating and sending invoices, especially for international clients.

Read more: Best Invoice Apps in 2024: Top 16 Invoicing & Billing Software

7. Account for Additional Costs

International invoices and payments may come with hidden costs. So make sure you have accounted for everything:

A. Shipping:

- Compare different shipping methods and providers.

- Factor in fuel surcharges and peak season rates.

B. Insurance:

- Consider comprehensive coverage for high-value shipments.

- Understand different Incoterms and their insurance implications.

C. Customs Duties and Taxes:

- You should research duty rates for your specific products in the target countries.

- Remember to include special taxes (think luxury and environmental fees).

8. Provide Multiple Payment Options

Diverse payment methods address different market needs. Businesses can better structure their international payment flows once they have a clear view of the payment landscape.

Wire transfers retain popularity in B2B due to their relative security. However, businesses should be transparent about one thing: cross-border transfers are at high processing rates.

Second, credit cards are convenient for most payments, but sometimes the cost of processing can get expensive. But this one is particularly worth it if the clients are international-based. Still, you should be aware there is often a charge associated with these facilities, i.e., currency conversion fees, which will come directly off your bottom line.

Additionally, providing local payment methods will increase the user experience in the countries you should research. For example, Alipay is an excellent choice for Chinese customers.

Conclusion

Navigating international invoices and payments is a make-or-break skill for companies going global. But, if you can get a grip on cross-border billing rules and use technology, such as e-invoicing, leveraging POS for international sales,.. you can avoid unnecessary problems and ensure good international money flows.

For overall business management, Flowlu is a comprehensive solution for overall business management, including CRM, project management, financial tracking, and international invoicing to keep you organized in the global marketplace. Why wait? Visit the Flowlu website to learn how they can help your business go global! Thank you for reading.

Managing international invoices and payments presents unique challenges, including fluctuating currency exchange rates, delays in payment processing, varying tax laws, and regulatory requirements across countries. Businesses also face complexities with multiple payment methods and potential language barriers, which can impact timely and accurate invoice processing.

Key components of an international invoice typically include contact information for both seller and buyer, invoice number and date, detailed descriptions of goods or services, quantity, unit price, total amount due, currency used, VAT information, payment terms, and shipping details. Additional charges like freight and insurance may also be itemized to ensure compliance and clarity for customs and legal purposes.

Businesses can simplify cross-border invoicing by using electronic invoicing (e-invoicing) to automate and streamline the process. A comprehensive financial management system, like Flowlu, can also help by providing real-time currency updates, customizable invoice templates, and seamless integration with various payment methods to reduce errors and expedite payment.